If you're struggling to understand the complexities of investing and want an uncomplicated investment system, look no further than dollar-cost averaging, or DCA. It involves investing consistently with profitable returns over time, despite market fluctuations.

In this article, you'll learn how to invest like a pro and grow your wealth over time without anxiously analysing the share market daily. You'll also learn the potential benefits behind dollar-cost averaging, examples of how it is used, and how you can apply this powerful method of investing.

Image source: Getty Images

What is dollar-cost averaging?

Dollar-cost averaging is an investment strategy that aims to take the guesswork out of investing.

Instead of trying to 'time the market' by buying shares when prices are low and selling when prices are high, adherents of the DCA strategy invest regularly and consistently, regardless of market conditions.

The idea is that, over time, the ups and downs of the market will average out (hence the name). This means that DCA is often best suited to investors with a long investment time horizon because it accumulates wealth over time (but may still incur losses over the short term).

Think of DCA like this…

Financial advisers, market commentators, and we here at the Fool emphasise how important it is to diversify your investments. "Don't put all your eggs in one basket" is the overarching message.

This is because when you have a diversified portfolio, you aren't reliant on the performance of just one investment for your entire wealth. When you're diversified, if one of your investments fails, you still have plenty of others to fall back on.

Well, it's the same theory with dollar-cost averaging, but instead of spreading money out over multiple investments, you're spreading it out over time. That's four-dimensional investing, people!

DCA: How it works

We can demonstrate the DCA strategy with a simple example.

Let's compare two investors, each with $5,000 to invest in a particular company. Investor 1 (let's call her Jane) invests her $5,000 in one lump sum on Day 1. Her friend Jack instead decides to invest his $5,000 in five $1,000 payments on the first day of every month over the next five months.

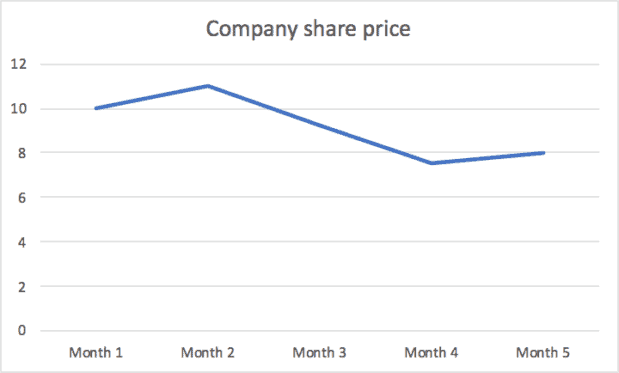

The company they want to invest in is a volatile tech stock, and its share price tends to fluctuate quite a bit from month to month, like so:

The company's share price starts at $10, increases to $11 by Month 2, then falls to $9.25 in Month 3, $7.50 in Month 4, and then recovers slightly to $8 in Month 5.

Jane invested her $5,000 when the share price was $10, and purchased 500 shares (ignoring brokerage costs). By Month 5, her 500 shares are now worth $8 a pop, or $4,000 in total – down 20%, so not great.

Jack, however, invested his $5,000 over time: $1,000 when the share price was $10, another $1,000 when the share price was $11, and so on. Here's how that looks.

| Time | Investment | Share price | Units purchased |

| Month 1 | $1,000 | $10.00 | 100 |

| Month 2 | $1,000 | $11.00 | 90 |

| Month 3 | $1,000 | $9.25 | 108 |

| Month 4 | $1,000 | $7.50 | 133 |

| Month 5 | $1,000 | $8.00 | 125 |

By Month 5, Jack has accumulated 556 shares (ignoring fractional shares) to Jane's 500 – that's 10% more shares! This also means that Jack ends the five months with a portfolio valued at almost $4,500 (556 x $8 per share), significantly higher than Jane's.

And therein lies the power of DCA.

DCA and compounding

A DCA strategy is particularly effective if you reinvest the dividends you earn into the market. Many shares offer dividend reinvestment plans that enable you to set this process up automatically.

This harnesses the power of compounded returns. Think of the dividends you earn on your shares like interest you receive on your bank account. Once that money is credited to your account, it is added to your balance and now forms the basis upon which your next round of interest is calculated. The ability to earn interest on your interest is called compounding, and it can quickly increase your wealth over time.

We already have plenty of articles about the magic of compounding, so we won't detail the mechanics here. However, a quick example can show you how it works over time.

The power of compounding over time

Let's say you put $10,000 into a term deposit that pays 5% interest per annum, compounding monthly. Then you make no further contributions and simply leave your money in the term deposit to grow over time.

After one year, your balance will have increased to about $10,512, meaning you earned $512 in interest in your first year.

After two years, your balance will have increased to $11,049. This is an increase of $537 in your second year – meaning you earned more interest in year two, even though you didn't do anything.

After three years, your balance will have increased to $11,615, meaning you earned $566 in interest in year three. Again, you earned more interest in the third year than your second year, even though you made no additional contributions.

And this pattern will continue out into the future as long as you leave your money there to compound. The more frequent the compounding periods, or the longer timeframe you have to invest, the more interest you will earn – simply by sitting back and letting your money do all the work.

You might already be dollar-cost averaging

If you are working, you are likely already dollar-cost averaging through your superannuation fund without even realising it. In a super scheme, your employer deposits super payments directly into your fund at regular intervals, and your fund then uses this money to buy more shares or other assets, such as bonds, on your behalf.

This means your super contributions are being invested regularly (each time you get a paycheque) regardless of the market's state. It sounds an awful lot like dollar-cost averaging! And as a result, the more contributions you make, the more wealth you grow over time.

Your super fund is most likely investing in a well-diversified portfolio, but it is always worth checking out exactly how your fund is investing your money.

So, look at your account and your fund's investment strategy (such as balanced or growth). Some funds will allow you to change strategy in accordance with your risk tolerance, so give them a call to discuss your options.

And while we're on the subject, it's also worth ensuring that your super fund has a good track record for delivering solid and reliable returns. You can use the new government YourSuper comparison tool on the Australian Taxation Office website to compare the performance of all the basic MySuper funds.1

If you're in a different type of fund, simply use Google to research how your fund's historical performance compares to all the other funds out there. You may be surprised — even astounded — at the difference between them.

How do market conditions impact DCA?

The share market fluctuates for all sorts of reasons, such as in response to changes in interest rates, election results, commodity supply and demand, random news updates, and black swan events (like a global pandemic, ever heard of it?).

All these factors make markets highly unpredictable, and prices tend to move up and down constantly. This can make investing a nerve-wracking experience, particularly when you're just starting out.

But adopting a dollar-cost averaging strategy means you can avoid much of that anxiety.

If you invest all your money at a single point in time, you are entirely exposed to every price fluctuation from that point onwards. This means that if the market falls, it might cause you to panic and make bad investing decisions.

But if you invest smaller portions over time, your average purchase price changes, influenced by changes in the share price. This happens because a DCA investor is able to buy more shares when prices fall but fewer shares when prices rise.

This reduces your portfolio volatility (in other words, your risk). It makes DCA a particularly effective strategy to follow when markets are volatile, especially if you are more risk-averse or don't have the time to watch the markets closely.

Benefits of dollar-cost averaging

There are many benefits of dollar-cost averaging – let's look at a few below.

There's no need to time the market: Waiting for the market to reach a specific price point is like waiting for Donald Trump to release his tax returns – it ain't gonna happen. However, when you invest every month, despite the share price, you're often going to be able to purchase lower-priced shares and reap the benefits in the future.

DCA saves time: Analysing market conditions, studying trends, and reading financial reports can be a full-time job. Most casual investors don't have time for that. If you have a job or business, you likely won't have that extra time to read up on investment opportunities before making a purchase.

With dollar-cost averaging, you invest a small amount at regular intervals, regardless of the share price. This means you can focus more on your job or business, producing the income you need to invest back into your share portfolio.

It's easy: Applying a dollar-cost averaging strategy is effortless. All you have to do is click the buy button, and you're off to the races. There's no financial complexity behind it – just remind yourself to make the investment every month, and you're done!

What are the drawbacks of DCA?

Despite the many benefits of DCA, there are still some drawbacks.

Fees: Each time you make a trade, you must pay brokerage costs and other transaction fees. So, making many investments over regular intervals instead of one lump sum payment means paying more fees. While higher costs shouldn't be a reason not to pursue a DCA strategy, you should still be aware of these costs, as they can quickly eat into your returns.

Not as effective in a bull market: When prices rise consistently — as they would in a bull market — a DCA strategy will underperform a lump sum investment made at the beginning of the bull run. This is because, as prices rise, DCA investors are able to purchase fewer shares each time they invest.

Of course, the opposite is true in a bear market, where a DCA investor can buy more and more shares each time they invest. This means they will reduce their losses compared to a lump sum investor.

These market fluctuations tend to even out over time, making DCA a better longer-term investing strategy.

The bottom line

Dollar-cost averaging is attractive for beginner investors as the barrier to entry is low. Additionally, you don't need any specialised knowledge, financial planning or an understanding of complex financial instruments, nor do you need to spend hours on market analysis to get started.

All you need is the commitment and discipline to stick to this method and make regular contributions over the long term.

Although dollar-cost averaging doesn't guarantee a profit in the short term, it does force you to make regular investments to create greater wealth. You will soon see its effect in evening out market fluctuations, enabling you to grow your portfolio steadily.