Patience is one of the best virtues that could create real wealth for ASX investors.

Yet it's easier said than done.

Human nature dictates that people can't help taking a peek into their portfolios on a daily basis to check if it's up or down.

But if you're disciplined enough to buy quality companies and you keep track of how the business is going, there is no need to check the stocks constantly.

After all, you don't check the valuation of your house on a daily basis — and that's the largest asset that most Australians have.

'A strong position' at a 29% discount

Yes, stock markets do dive. But over the longer term, historically, it trends upwards.

So instead of worrying about short-term movements, try buying some quality but cheap ASX shares then not looking at them for a couple of years.

Buy some this month before the year is over, and promise yourself to leave them alone until you pop the champagne for new year's day in 2026.

Some bargains out there right now, according to experts, include lithium stock Mineral Resources Ltd (ASX: MIN), which is 29% down from its January peak.

The global price for the commodity plunged this year due to the struggling global economy, especially China.

But in the longer run, the push to reduce carbon emissions means the world will have an insatiable appetite for high-powered batteries.

And hence lithium.

The great bonus for those willing to buy Mineral Resources shares is that it's like adding a few different stocks in one.

Earlier this week BW Equities equity salesperson Tom Bleakley explained to The Bull how this works.

"Mineral Resources has accumulated substantial stakes in quality lithium companies Wildcat Resources Ltd (ASX: WC8) and Azure Minerals Ltd (ASX: AZS)," he said.

"Mineral Resources' lithium exposure leaves it in a strong position as the industry matures."

Grab these cheap ASX shares at the start of the resurgence

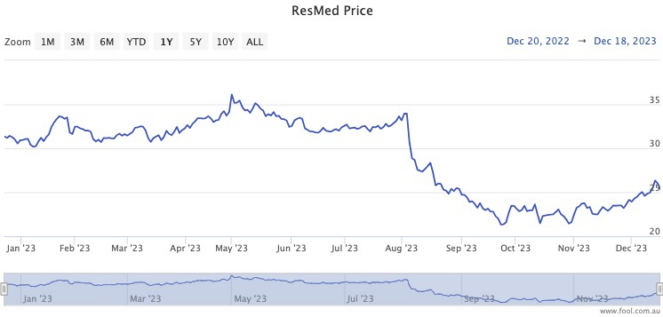

Another cheap ASX stock could be sleep apnoea device maker Resmed CDI (ASX: RMD).

It's fallen 24% since reporting season on fears that new GLP-1 weight loss drugs like Ozempic could put a dent in ResMed's addressable market.

Many professional investors insist this panic is overblown and that this dip is, if anything, a chance to buy at a nice discount.

CMC Invest currently shows 18 out of 24 analysts recommending the healthcare stock as a buy.

In fact, the market seems to be waking up to the bargain, with ResMed shares surging more than 19% over the past seven weeks.

Of course, if you do lock these shares away until 2026, just check every so often that your original investment thesis still holds.

If the business and the investment case has changed, then you do need to take action.

But otherwise set the alarm for 1 January 2026.