The Core Lithium Ltd (ASX: CXO) share price is on fire today.

Shares in the S&P/ASX 200 Index (ASX: XJO) lithium stock closed yesterday trading for 24.5 cents. Shares leapt to 28.0 cents apiece in earlier trade, putting the lithium miner up 14.3%.

After some likely profit-taking, shares are currently swapping hands for 26.7 cents, up 9.0%.

This sees the Core Lithium share price racing ahead of the ASX 200, with the benchmark index up 1.6% at this same time.

That's going to come as bad news to the sizeable cohort of short sellers betting against the company. On Monday, Core Lithium was the third most shorted shares, with a short interest of 9.9%.

Why is the Core Lithium share price soaring today?

It's not just Core Lithium outperforming today.

Here's how these other top ASX 200 lithium stocks are faring at this same time:

- Pilbara Minerals Ltd (ASX: PLS) shares are up 7.8%

- Allkem Ltd (ASX: AKE) shares are up 9.0%

- IGO Ltd (ASX: IGO) shares are up 9.5%

- Liontown Resources Ltd (ASX: LTR) shares are up 9.4%

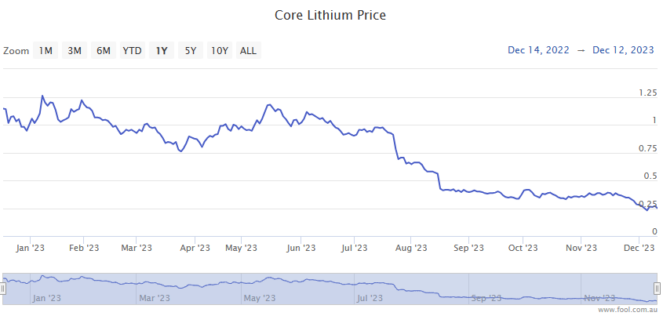

So, with no breaking news out from the sector and the lithium price remaining down some 80% in 2023, why is the Core Lithium price racing higher today?

Well, it looks like investors have the United States Federal Reserve to thank.

Overnight, the Fed opted to hold interest rates steady in the range of 5.25% to 5.50% for the third consecutive meeting.

Fed chair Jerome Powell noted that inflation was coming under control while the outlook for the US economy remained solid, with unemployment figures remaining low. This saw markets upping the odds of one or more rate cuts from the Fed in 2024.

A strong US economy and potentially lower interest rates may drive an increase in demand for new EVs and the lithium that helps power them.

The news out from the Fed saw US lithium giant Albemarle Corporation (NYSE: ALB) close up 9.5% overnight, roughly in line with the current gains posted by the Core Lithium share price.