Honestly, there are not many better places to retire than Australia.

That's because our country has some of the best dividend stocks in the world.

This is no fluke. ASX-listed companies are heavily incentivised to return capital back to shareholders via dividends than other methods, such as buybacks.

The incentive is Australia's tax laws that prevent double taxation of dividends.

If a company has paid corporate tax on its profits, dividends coming out of that are accompanied by franking credits.

Investors with these franking credits do not have to pay income tax on that income because corporate tax was already paid on it.

So for a retiree ASX dividend shares are an efficient way of producing a stream of cash to spend on their day-to-day living.

Beware the siren song of ASX dividend shares with massive yields

Of course, this doesn't mean just picking out the stocks with the highest dividend yields.

Every investor wants to protect their capital, but it's even more important to those in the post-work phase of their lives.

This means that some yield may have to be sacrificed from the highest income producers in order to pick businesses that are less likely to dramatically decline or are highly cyclical.

This could mean you're left with stocks that not only have less chance of tanking, but the dividend output will be more reliable (if not quite as prolific in some years).

Let's check out three such examples out there right now:

Are shoes more essential than high fashion?

Consumer discretionary retail might be out of favour at the moment with the economic uncertainty, but Accent Group Ltd (ASX: AX1) has proven to be pretty resilient.

The stock has actually gained 8.1% so far this year, all while paying a sensational fully franked yield of 9.6%.

Perhaps its footwear bias means the Accent Group is better able to withstand the higher interest rates than retailers that sell more expensive or discretionary products.

After all, people still have to replace worn shoes, regardless of how much money they have in their wallet.

Admittedly, the stock price has dipped just short of 30% since April, but that could provide investors with a golden buying opportunity to rake in a very high dividend yield along with capital upside.

Decent yield while leaving a buffer

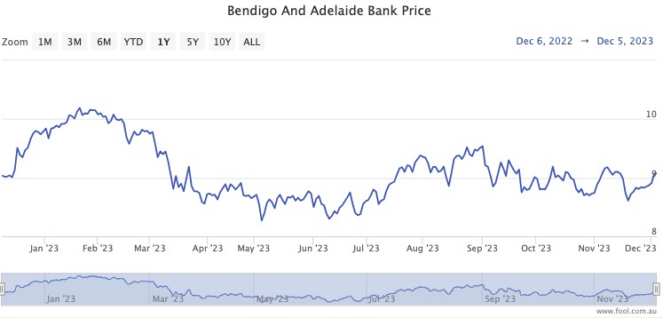

Over in the banking sector, Bendigo and Adelaide Bank Ltd (ASX: BEN) pays a fully franked 6.7% yield.

The Motley Fool lead advisor Edward Vesely likes the stock for retirees because of "relative stability of the banking industry in Australia".

"It also has a payout ratio in the high 50s, providing a buffer against dividend cuts in case of an earnings downturn," he said.

"It has an exposure to agribusiness — which provides for an alternative source of earnings — and remains classified as an 'unquestionably strong' bank in accordance with APRA's capital requirements."

The Bendigo share price has dipped 4.3% this year, presenting a tempting entry point at the moment.

These shares are at 40% discount to assets

Like most real estate stocks, Growthpoint Properties Australia Ltd (ASX: GOZ) has suffered from a sell-off as interest rates have risen.

But as the rate nears the peak, the Growthpoint share price is starting to show signs of a turnaround, rising more than 22% since the end of October.

This still leaves it with an outstanding yield of 9.2% unfranked.

The great ace for Growthpoint is that its last reported net tangible assets per share was $4, meaning the stock is still trading about 40% below what its properties are worth.

This gives it decent upside as rates stabilise and investors return to the real estate sector.

Four out of the six analysts that study Growthpoint now think it's a buy, according to CMC Invest.