Just because a stock has risen rapidly doesn't mean that it's a bad buy.

In fact, soaring ASX shares likely indicate market confidence that the business is doing something right. All that matters is whether there is more potential to grow.

Keeping that in mind, let's check out these two stocks that went gangbusters last month, which the team at Celeste Australian Small Companies Fund are backing for further returns:

Did somebody say…?

If the ticker doesn't give it away, Collins Foods Ltd (ASX: CKF) is one of the larger licensees of Kentucky Fried Chicken restaurants in Australia. The company also has a smaller presence in Europe.

The Celeste team liked what it saw in November.

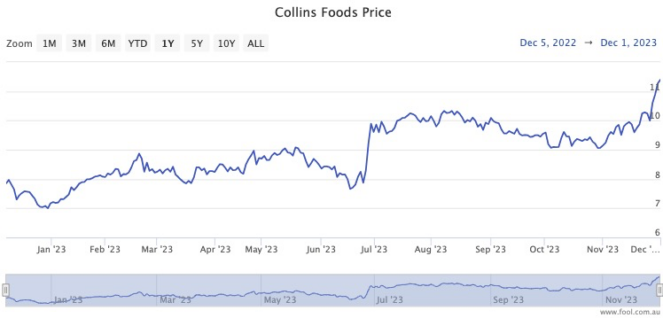

"Collins Food rose 24.1% off the back of a strong 1h24 result," read its memo to clients.

"Collins delivered EBITDA of $110 million, 15.2% ahead of the previous corresponding period (pcp) and was a 7.3% beat against expectations."

Collins Foods is simultaneously growing revenue while cutting expenses.

"All divisions grew sales, with Australia same-store sales growth (SSSg) of 6.6% and Europe SSSg of 8.8% respectively.

"Effective cost containment saw group EBITDA margins expand 87 basis points vs 2h23 with each division reporting margin expansion."

The last few years have seen supply cost inflation ravage fast food operators, and Collins was no exception.

But the analysts think the end is near for that headwind.

"While cost pressures remain, we believe these are largely transitory," read the Celeste memo.

"With a strong brand, continued execution by management will support double-digit earnings growth over the medium to long-term."

The Collins Foods share price is now an impressive 58% above where it started the year, while paying out a fully franked dividend yield of 2.5%

The ASX shares heading up in synch with electric car adoption

Fleetpartners Group Ltd (ASX: FPR) has been seen as a beneficiary of Australia's adoption of electric cars, and this adoration continued in November.

"FleetPartners Group rallied 13.7% in Nov after a strong FY23 result.

"Fleetpartners Group continues to benefit from EV tailwinds, with new business writings up 13% and assets under management up 7%."

Indeed the share price has rocketed more than 45% year to date, with Celeste analysts expecting more of the same.

"The order pipeline remains at record highs, underwriting future growth," read their memo.

"Operating expenses were well managed despite increased activity levels and broad-based inflationary pressures. The company announced a further $30 million on-market share buyback."