While it can be frightening to see a stock plunge suddenly, it may be worth considering whether the panic is an overreaction.

Because if it's just the market being excessively emotional, shrewd investors could pick up cheap shares that could bring handsome returns over the long run.

The team at Celeste Australian Small Companies Fund, in a memo to clients, named two ASX shares that have been tumbling in recent weeks but that they're convinced will rise sooner or later:

'Expansive network in a defensive industry'

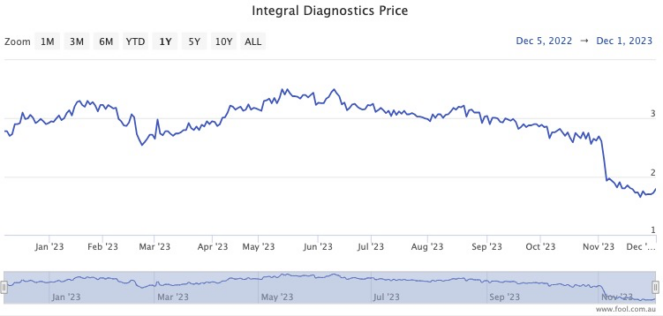

Medical imaging provider Integral Diagnostics Ltd (ASX: IDX) fell off a cliff last month.

"Integral Diagnostics fell 33.5% during the month following a disappointing trading update," the Celeste analysts stated.

"Clinical staff shortages and cost inflation have seen margin contraction, despite strong top-line growth with revenues up 8.4% in the first quarter."

The fund is keeping the faith in the healthcare stock though, with the business heading in the right direction.

"Management is also implementing a number of productivity initiatives aimed at offsetting these cost pressures.

"We remain attracted to the group's expansive network in what is a defensive industry and expect cost pressures to ease over time."

Integral is admittedly polarising as to whether they're cheap shares or not.

According to CMC Markets, eight analysts consider it a strong buy versus eight who think it's a hold.

Aussie Aussie Aussie

Aussie Broadband Ltd (ASX: ABB) investors have had an excellent 2023, but the last few weeks have been a reality check.

The share price has fallen more than 11% since 18 October.

Celeste analysts feel like the recent capital raise has the market divided on the merits.

"Aussie Broadband fell 2.6% in Nov as the market digested a $120 million institutional capital raise at $3.55 per share.

"Aussie Broadband plans to use the funds raised combined with an upsized $435 million debt facility to pursue further deals."

The Celeste team is comfortable with Aussie's acquisition strategy.

"The capital raise followed Aussie Broadband entering a scheme implementation agreement with Symbio Holdings Ltd (ASX: SYM) at an implied value of $3.01 per SYM share," read the memo.

"The accretive acquisition is expected to complete in Feb 2024 and Aussie Broadband's future growth prospects remain compelling."