High inflation and interest rates have been a major concern for ASX retail shares investors in 2023.

Everyone knows a pullback in discretionary spending is underway, and it may get worse before it gets better.

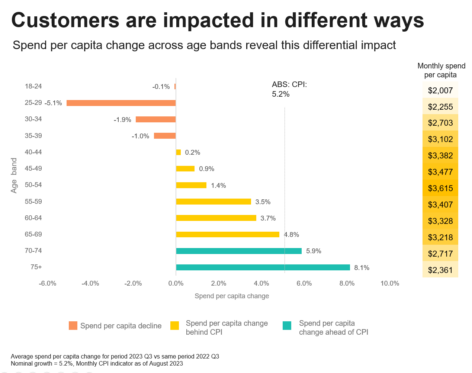

Now, new data shows Australian consumers under 40 years of age are doing it toughest in today's cost-of-living crunch.

In particular, the CommBank iQ Cost of Living Insights Report reveals 25 to 29-year-olds have cut their spending the most in recent months.

The report uses spending data for the September 2023 quarter and compares it to September 2022.

The data shows a 5.1% decline in total spending among 25 to 29-year-olds. This was also the only age bracket to decrease both discretionary spending, down 6.2%, and essential spending, down 3.7%.

While most people at this age do not have home loans, they are feeling the impact of higher interest rates through rising rents. CoreLogic data shows rents have risen by 30% over 38 consecutive months.

Within their discretionary budgets, 25 to 29-year-olds are prioritising entertainment, with that spending up 13%, while reducing spending on household goods by 17%, apparel 10%, and retail services 9%.

Conversely, spending among Australians aged over 65 increased by 6% over the September quarter.

At this age, many Australians are less likely to be carrying significant debt, they have access to their superannuation and the age pension, and they're receiving higher interest on their savings at the bank.

CommBank iQ Head of Innovation and Analytics Wade Tubman said:

We're seeing consumers in their twenties cut back spending but still leave room to fund experiences.

We've also seen younger people redirecting discretionary spending from things like clothes and homewares, to spend on cinemas and ticketed events such as concerts and sport.

So, what does this mean for youth-focused ASX retail shares?

Australian retailers are already well aware of the impact of today's cost-of-living crisis.

It's a tough environment for them because many of their costs of business are going up with inflation while their customers are buying fewer products and services. That's a double whammy, for sure.

Plenty of retailers have noted more caution among customers in recent months. But a pullback in spending among a company's primary customer, or one of their main ones, is a specific headwind.

Premium youth fashion retailer Universal Store said its like-for-like sales over the first 20 weeks of FY24 were down 6.4% on the same period in FY23.

CEO Alice Barbery said:

The Group continues to see changes in customer spending habits, specifically a decline in spending in regional areas of eastern Australia, contrasting with more robust performance in metropolitan & CBD locations.

At JB Hi-Fi's AGM, CEO Terry Smart discussed "a tougher retail trading environment" in FY24.

Sally Pitkin AO, the chair of Super Retail, which owns Rebel, says FY24 presents "serious challenges" for the retail sector as "economic conditions remain tight and cost-of-living pressures become more acute".

Here are some examples of ASX retail companies that have either an exclusive youth focus or are very popular with young customers. We document their share price performance in 2023 below.

- Universal Store Holdings Ltd (ASX: UNI) shares are down 34% to $3.42 in the year to date (ytd)

- Lovisa Holdings Ltd (ASX: LOV) shares are down 17% to $19.19 ytd

- Accent Group Ltd (ASX: AX1) shares are up 6.8% to $1.81 ytd

- JB Hi-Fi Limited (ASX: JBH) shares are up 13.6% to $47.48 ytd

- Super Retail Group Ltd (ASX: SUL) shares are up 29% to $13.89 ytd.

What's next for ASX retail shares?

Some relief may be in sight. Lower-than-expected inflation data released this week may mean the end to rate hikes, which would reduce the pressure on consumers and, therefore, retailers.

CBA economist Stephen Wu recently described per capita spending in Australia as "undoubtedly weak".

He noted retail trade was rising at just 1.2% per annum — the lowest growth rate outside of the pandemic since November 2010 — despite a significant increase in population due to the return of migrants.