Well, what a year! As we enter the final month of 2023, we can be forgiven for feeling a little beaten up amid some bruising market forces, both at home and across the world.

But long-term ASX investors know the best way to fight back is to roll with the punches. History shows us that the ASX market will always return stronger than ever after a correction. And there are some quality stocks to snap up right now at discount prices.

To help with some top ideas for your Christmas stocking, we asked our Foolish writers to let us know which ASX shares they reckon are worth buying this month. Here is what the team came up with:

6 best ASX shares for December 2023 (smallest to largest)

- Betashares Global Cybersecurity ETF (ASX: HACK), $796.35 million

- Super Retail Group Ltd (ASX: SUL), $3.14 billion

- Pilbara Minerals Ltd (ASX: PLS), $10.89 billion

- Resmed Inc (ASX: RMD), $13.74 billion

- Sonic Healthcare Ltd (ASX: SHL), $13.85 billion

- Xero Limited (ASX: XRO), $15.61 billion

(Market capitalisations as of market close 30 November 2023).

Why our Foolish writers love these ASX stocks

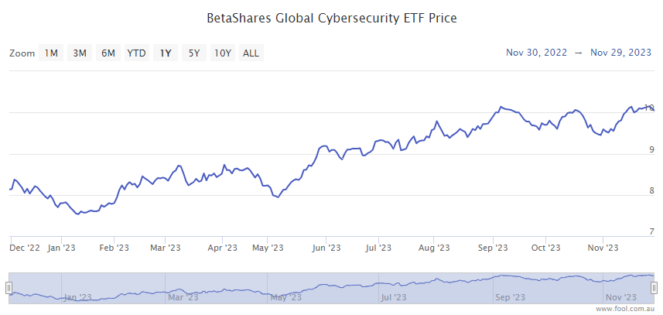

Betashares Global Cybersecurity ETF

What it does: This ASX exchange-traded fund (ETF) invests in a basket of cybersecurity companies sourced from all around the world. It provides a thematic exposure to one of the fastest-growing trends in the market.

By Sebastian Bowen: This Global Cybersecurity ETF has been on my radar for a long time, and quite frankly, I wish I had bought it sooner. Maybe this December will finally be time.

As most investors will accept, the need for tight cybersecurity protections for individuals, businesses and governments only seems to grow by the day. Every year, at least one Australian company seems to suffer a major cyberattack.

This ETF holds a wide range of companies that seek to provide solutions to this very problem. Some of its recent top holdings include Palo Alto, Fortinet, Okta and Zscaler.

I think business and governments will increase their allotted budgets to cybersecurity over the coming decade and beyond. That's why this ETF might well be worth a look this December.

Motley Fool contributor Sebastian Bowen does not own shares of any stocks mentioned.

Super Retail Group Ltd

What it does: Super Retail Group houses some of Australia's most popular outdoor brands: Supercheap Auto, Rebel, BCF, and Macpac. Founded by Reg Rowe and his late wife, Hazel, 51 years ago – the company has grown to 736 stores strong.

By Mitchell Lawler: I have previously described the basis for my bullish stance on Super Retail Group. In short, rising living costs are conducive to older vehicles being maintained longer – delaying that new car purchase. That normally means more money flowing to replacement parts, oils, filters, etc.

In addition, the company has proven resilient when other ASX retail shares have reported deteriorating sales. The latest trading update from Super Retail Group shows a 2% like-for-like sales growth for the first 16 weeks of FY24. This may seem unremarkable, but it is a solid outcome under the circumstances.

Lastly, the debt-free balance sheet and 12 times earnings multiple lead me to believe Super Retail shares are attractively priced.

Motley Fool contributor Mitchell Lawler does not own shares of Super Retail Group Ltd.

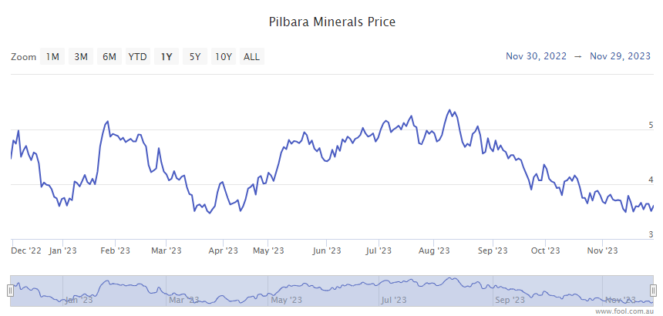

Pilbara Minerals Ltd

What it does: Pilbara Minerals is an Australian lithium-tantalum miner. Its flagship project is the 100%-owned Pilgangoora Project in Western Australia, which is one of the world's largest hard rock lithium-tantalum deposits.

By Bronwyn Allen: There's an interesting debate going on over Pilbara Minerals shares. The stock has an 18.5% short position, so plenty of pro traders think the share price will fall. And it's certainly has been on a downward spiral, tumbling about 30% since its 52-week peak in August.

On top of that, Goldman Sachs reckons lithium commodity prices won't bottom til 2025. So yeah, why would you buy Pilbara Minerals shares today? Well, there's a flip side. Macquarie analysts are very bullish and say the Pilbara Minerals share price will almost double within a year! They give it a price target of $7.10 and an outperform rating. Hmm, you decide.

Motley Fool contributor Bronwyn Allen does not own shares of Pilbara Minerals Ltd.

ResMed Inc

What it does: ResMed develops and sells sleep technology-related medical devices, like flow generators and CPAP masks, along with cloud-based software applications to diagnose respiratory disorders. The company also provides software platforms to care for patients in out-of-hospital settings.

By Bernd Struben: I think ResMed was oversold following the 4 August release of the company's FY23 results, where ResMed reported a 0.8% contraction in gross margins and fell short of lofty earnings expectations. By 27 October, the ResMed share price was down 36%.

That's when the company reported its Q1 results, revealing a modest quarter-on-quarter improvement in gross margins and a 16% year-on-year quarterly boost in revenue to US$1.1 billion. Shares have gained 8% since then.

And with the company beginning to roll out AI-driven software products to boost its digital health offerings, I think there's a lot more growth potential ahead.

Motley Fool contributor Bernd Struben does not own shares of ResMed Inc.

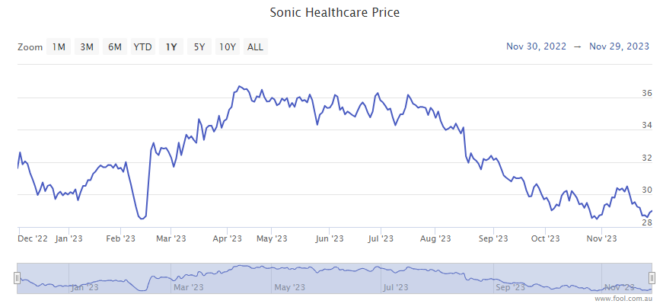

Sonic Healthcare Ltd

What it does: Sonic Healthcare provides pathology in a number of countries, including Australia, the United Kingdom, the United States, Germany, Switzerland, New Zealand and so on.

By Tristan Harrison: The ASX healthcare share has suffered from weaker investor confidence in recent months, along with several others in the sector. The Sonic Healthcare share price is down close to 17% in six months, making it much better value to me.

It has defensive earnings – we all get sick from time to time – and its base business revenue and profit keep rising. After four months of trading in FY24, it had seen base business organic revenue growth of 7%.

I think shareholders can benefit in the long-term from Australia's growing and ageing population, acquisitions, investments in AI and a growing dividend.

Motley Fool contributor Tristan Harrison does not own shares of Sonic Healthcare Ltd.

Xero Limited

What it does: Xero is a leading cloud accounting platform provider to small businesses across the globe.

By James Mickleboro: Xero's shares have pulled back materially from recent highs. This has been driven partly by the release of softer-than-expected half-year results last month. Though, it is worth noting that Xero still delivered a 21% increase in sales to NZ$800 million and a 90% jump in EBITDA to NZ$206 million. So, it certainly wasn't a bad result.

I think this is a buying opportunity for buy-and-hold investors, given the quality of its offering and its huge market opportunity.

In respect to the latter, Goldman Sachs estimates that Xero has a NZ$76 billion total addressable market globally, which gives it a huge runway for growth over the next decade.

It is partly for this reason that the broker currently has a buy rating and a $141.00 price target on Xero's shares.

Motley Fool contributor James Mickleboro owns shares of Xero Limited.