With inflation settling down, Australia is tantalisingly close to welcoming an end to interest rate hikes.

The prospect could be a nice catalyst for certain ASX shares.

Two groups that could benefit are technology and resources.

The tech sector is full of growth stocks that boom when future cash flows improve, which is what happens when rates stop rising.

Mining businesses have their fortunes closely tied to the health of the economy because commodity prices fluctuate up and down according to demand. Interest rate relief is a boost to the economy as it gives consumers more confidence to spend.

There are two ASX tech shares that I am bullish on right now that are overlaps of these sectors:

A startup thrilling the market

Chrysos Corporation Ltd (ASX: C79) is a technology provider for mining clients, especially in the area of materials analysis or assay as it is known in the industry.

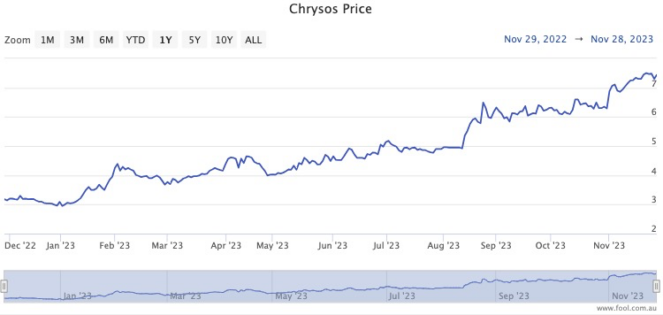

Believe it or not, the Chrysos share price has rocketed more than 150% so far this year.

It's no wonder, with the company producing its first significant amount of revenue in the 2023 financial year and already turning a net profit.

All three analysts surveyed on CMC Invest rate the stock as a buy right now.

The Motley Fool's James Mickleboro reported this week that Bell Potter has just started covering Chrysos with a buy rating.

"The broker highlights that its disruptive proprietary PhotonAssay technology is becoming the new gold standard for assay sampling."

More mature tech shares with runs on the board

A more mature technology supplier to the resources industry is RPMGlobal Holdings Ltd (ASX: RUL).

Its share price is 11.2% down for the year, but that could all change in 2024 as the economy picks up.

According to CMC Invest, both Moelis Australia and Veritas Securities rate RPMGlobal shares as a strong buy.

Last month, the Motley Fool's Tristan Harrison picked the stock as one that he can easily see beating the market over the next decade.

"[RPMGlobal's] doing an excellent job at changing its customers to software as a service (SaaS)," he said.

"Plenty of software businesses have proven that they can deliver good returns thanks to good margins and revenue growth, and this business could be another potential winner."

Over the last five years, the RPMGlobal share price has soared more than 150%.