Finally, good news is good news.

On Wednesday, the latest monthly inflation figure came in much lower than what analysts were expecting. This has triggered much speculation that the Reserve Bank of Australia could be finished with interest rate hikes.

"This monthly CPI release, combined with weak consumer spending and rising numbers of unemployed people, means the RBA will almost certainly hold the cash rate steady at the December meeting," said CreditorWatch chief economist Anneke Thompson.

"This is good news for retailers and summer holiday makers, though consumers are likely to be wary of the fact that interest rates are likely to stay high until at least Q3 2024."

Once interest rates stabilise, it will have a buoyant effect on most ASX shares as consumers open their wallets again.

In this environment, perhaps these three ASX shares could be the best deals at the moment:

'Appealing capital returns'

When the economy picks up, energy consumption rises.

It's as simple as that.

No wonder then that Santos Ltd (ASX: STO) is currently rated a buy by 14 out of 16 analysts surveyed on CMC Invest.

The shares are at an attractive entry point currently too, having discounted 12.6% since 20 October.

Seneca Financial Solutions advisor Tony Langford is bullish on Santos due to the potential catalyst from a 2.6% sale of Papua New Guinea LNG to Kumul Petroleum Holdings.

"We believe the stock provides good value at these levels on top of appealing capital returns."

Santos shares pay out an unfranked dividend yield of 5.1%.

Cashing in on electric cars

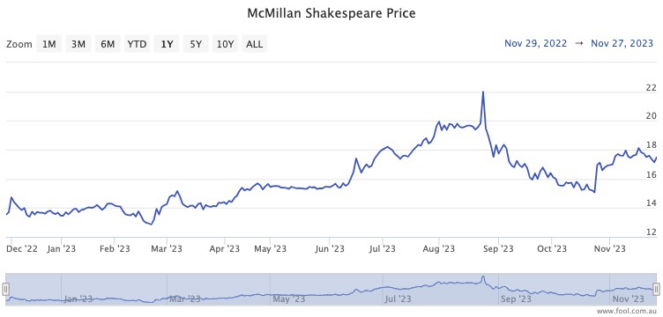

Another dividend stock many experts are bullish on is McMillan Shakespeare Ltd (ASX: MMS).

Five out of six analysts currently surveyed on CMC Invest reckon it's not just a buy, but a strong buy.

Despite, or perhaps because of, an 18.8% surge in the share price since 23 October, Fairmont Equities managing director Michael Gable is bullish on the salary packaging and novated leasing services provider.

He explained how the business has benefited from government incentives for electric car adoption.

"In the 12 months since the introduction of the policy, the portion of McMillan Shakespeare's novated lease orders related to EVs has increased rapidly, to 36%."

McMillan Shakespeare hands out an outstanding 7% dividend yield, all franked.

'Outlook looks very strong'

After a rough few years, the experts are backing CSL Limited (ASX: CSL) to return to its glory years.

According to CMC Invest, 14 out of 17 analysts rate the biotechnology giant as a buy.

The share price has plunged more than 15% since mid-June, but DNR Capital chief investment officer Jamie Nicol dismissed the market's fears about the adverse impact of new GLP-1 weight loss drugs.

"CSL has a small kidney dialysis business that will potentially be affected a little, but it's not much," he said.

"So it's caught up in that bucket causing the stock to derate, yet its outlook looks very strong and defensive."

Seneca Financials' Langford likes one particular business unit within CSL.

"We believe this blood products group is undervalued at these levels given its brighter outlook."