Even though interest rate rises seem to be nearing the end, stock markets have been nervous and anxious recently.

In fact, the S&P/ASX 200 Index (ASX: XJO) is trading 5.7% lower than the August reporting season, even after a mini revival this month.

DNR Capital chief investment officer Jamie Nicol said that the "outlook at the moment is quite challenging".

"There are a range of uncertainties impacting the market and these uncertainties can undermine equities in the short term," Nicol said in a DNR video.

"The high interest rate environment highlights uncertainty about the strength of the economy and what earnings companies will make into the future."

However, for shrewd investors, this presents a short window to pick up a bargain.

"This sort of market creates new opportunities to buy quality companies when they are out of favour for various reasons," said Nicol.

"Investors should look through the short term and think about what these companies are going to look like in three to five years."

There are two types of stocks he would target right now, and named an ASX 200 share for each category:

Resilient businesses that don't care about the economy

The first type of bargain is stocks that represent resilient businesses that are temporarily out of favour with the market.

"Some great businesses are starting to de-rate, especially companies with defensive outlook. A great example is CSL Limited (ASX: CSL)."

CSL shares have been disappointing over the past 12 months, plunging more than 13.6%.

Nicol admitted the biotechnology giant is battling the perception that new GLP-1 weight loss drugs like Ozempic would eat into its business.

But his team reckons, in reality, those medicines will "have very limited impact" on CSL's growth.

"CSL has a small kidney dialysis business that will potentially be affected a little, but it's not much," said Nicol.

"So it's caught up in that bucket causing the stock to derate, yet its outlook looks very strong and defensive."

Critically, CSL's fortunes aren't linked to a major external force that's worrying the market.

"It's not dependent on the economic climate to deliver a great outcome."

The ASX 200 company raking it in over in America

The second category of ASX 200 shares Nicol would buy at the moment is for businesses that will go gangbusters once interest rates have passed their peak.

These are prime targets for investors with long horizons.

"There are some cyclical stocks where the market's really thinking through the cycle and worried about the downside risk," said Nicol.

"This throws up opportunities if investors are prepared to look through the cycle a little bit."

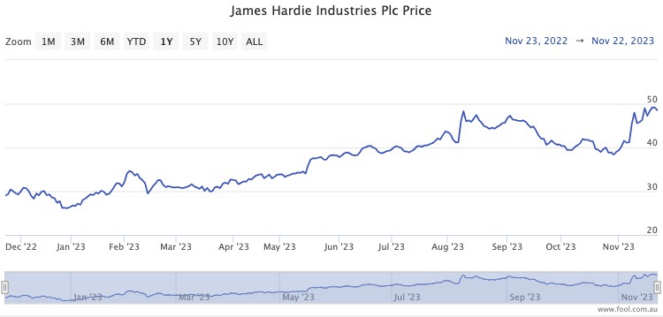

He named James Hardie Industries plc (ASX: JHX) as a prime example because of its association with the US housing cycle.

"Higher interest rates are typically negative for US housing. But the difference with this cycle is that a lot of American mortgage owners are locked into 30-year mortgages at very low interest rates," said Nicol.

"They are unlikely to move and will need to repair and remodel their homes, which will be a boon to James Hardie over the next year and a half."

And if there are Americans looking to buy a new home, James Hardie wins too.

"They are most likely looking to buy off a new home project because there are not as many homes for sale just on the regular market.

"In this scenario, James Hardie tends to do well with those large home builders."

So with such a win-win situation, Nicol reckons the stock is poised to rocket despite already gaining almost 80% this year.

"It's obviously a market leader, with great products and good margins."