Thermal coal miner New Hope Corporation Ltd (ASX: NHC) has had a rough time of it lately.

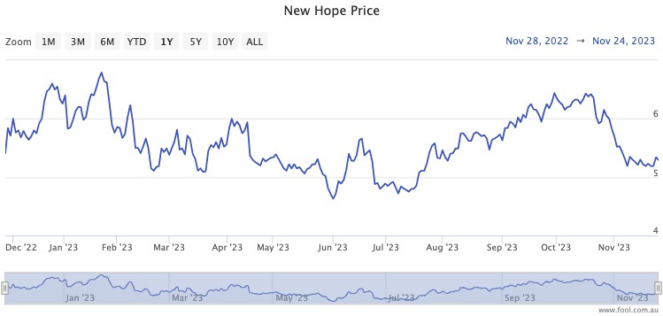

The share price has tumbled 16.7% since 20 October and is down more than 8% year to date.

The steep fall in recent weeks has meant that the dividend yield has ballooned to an enticing 9.6%, fully franked. If you include this year's special cash payouts, the yield is a stunning 13.1%.

So is it time to buy the dip on New Hope shares, or is this a value trap?

Coal prices down 70% over the past year

This year has not been the best for ASX coal shares, but Shaw and Partners portfolio manager James Gerrish said in his Market Matters newsletter that the industry's ready for a massive rebound.

"Market Matters is bullish on coal stocks through 2024/5," said Gerrish last week.

"Since COVID, the coal price has been on a rollercoaster ride, with the last 12 months [seeing] ~70% decline, taking prices back down to more sustainable levels."

He picked New Hope as his favourite coal stock for income.

Even though coal might be on the nose in a more environmentally aware world, it looks like it will take years before renewable energy sources become the dominant generator.

And the rapidly expanding middle class in emerging economies like India and China are demanding higher standards of living, which require tremendous amounts of energy.

The Motley Fool's Bernd Struben also named New Hope as his pick for harvesting dividends next year.

"Coal prices have come off the boil this year, but remain above historic levels, which should support New Hope's 2024 revenues and profits," he said.

"Drilling down to just a single income stock to deliver my… dividends, I'd target ASX 200 coal share New Hope Corp."

New Hope shares' longer term performance

Despite the recent struggles, New Hope shares have actually risen almost 60% over the past five years.

This year, it paid dividends totalling 70 cents while in 2022, investors raked in 86 cents.

Both revenue and net profit have headed upwards over the past three financial years.

So perhaps it's worth buying into New Hope shares now while they're cheap. But please remember that commodity prices can vary wildly over time and can push dividends rapidly lower or higher in the future.