Softening inflation figures out of the US on Wednesday morning sent ASX stocks soaring later that day.

The idea behind that was that interest rates could have now peaked, and that the next move could even be a cut.

So maybe that Santa Rally that many experts have been tipping could be for real?

If you're looking to take advantage of the turnaround, here are three ASX stocks that have been lagging this year but are set to take off now:

'A very strong opportunity'

With consumers dealing with far less money to spend than 18 months ago, it's no wonder jewellery retailer Lovisa Holdings Ltd (ASX: LOV) has seen its share price limp along.

So far in 2023, the stock is down 16%.

However, with overseas store expansion potentially a major growth catalyst, it has many fans in the professional investor community.

CMC Markets currently shows nine out of 14 analysts rating Lovisa as a buy.

The Motley Fool's Tristan Harrison this week expressed his bullishness for the retailer.

"The business has recently entered a number of new markets such as Canada, Mexico, Taiwan, Hong Kong, Poland, Italy, and more.

"I believe there is a very strong opportunity for the company to double its store count over the next five years, which could come with overall profit growing by a similar percentage if margins can be maintained."

Ready to surge when economy picks up

The RPMGlobal Holdings Ltd (ASX: RUL) share price has plunged more than 8% since 19 July.

The company provides services and technology to mining sector clients, which makes it something of a proxy for the fortunes of the resources industry.

And perhaps there is a thought that it should be bought while mining is at the bottom of the cycle, with both Moelis Australia and Veritas Securities rating RPMGlobal shares as a strong buy.

A couple of months back, the team at Forager Funds liked what it saw from RPMGlobal during reporting season.

"Software revenue rose more than 50%, with 56% of that dropping through to the segment profit line," read a report to its clients.

"This is despite the company paying a management incentive during the year for software sales that will be mostly recognised as revenue in subsequent years."

The panic is overdone for this ASX stock

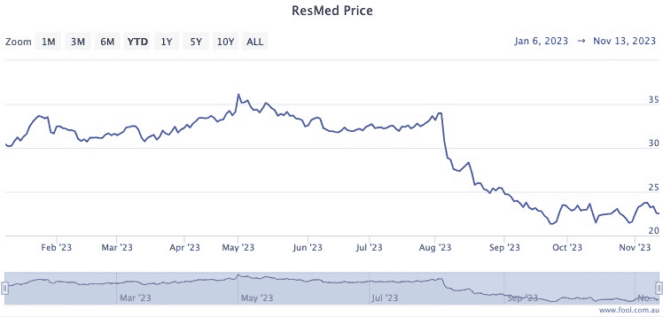

Resmed CDI (ASX: RMD) is arguably the most talked-about ASX stock in 2023, with the price falling almost 25% year to date.

The controversy is whether the rise of new GLP-1 weight loss drugs like Ozempic would devastate the sleep apnoea industry.

While there has been some panic about the threat causing ResMed's stocks to plunge, many experts reckon it's overstated.

Morgans is one of those investment houses that are backing the sleep apnoea device maker to surge again.

"While weight loss drugs have grabbed headlines and investor attention, we see these products having little impact on the large, underserved sleep disorder breathing market, and do not view them as category killers," read its memo.

"Nothing changes our view that the company remains well placed and uniquely positioned as it builds a patient-centric, connected-care digital platform that addresses the main pinch points across the healthcare value chain."