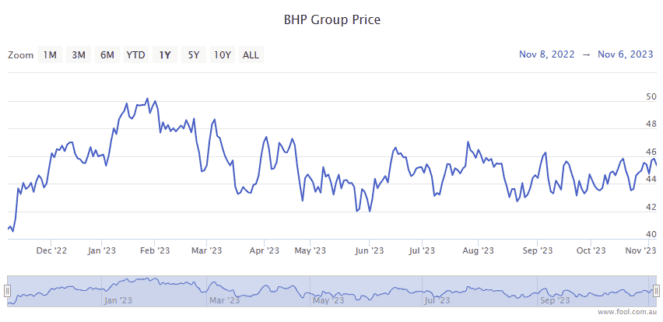

The BHP Group Ltd (ASX: BHP) share price is tumbling today.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed up 0.3% yesterday trading for $45.56. As we head into the Wednesday lunch hour, shares are swapping hands for $44.26, down 2.9%.

For some context, the ASX 200 is up 0.3%.

Though rival ASX 200 iron ore miners are also feeling the pressure, with the Fortescue Metals Group Ltd (ASX: FMG) share price down 1.8% and Rio Tinto Ltd (ASX: RIO) shares down 3.1% at this same time.

So, what's going on?

What's pressuring the ASX 200 miner today?

The BHP share price is facing headwinds following a retrace in the iron ore price.

The industrial metal, the biggest revenue earner for BHP, slipped 1.2% overnight to US$122.30 per tonne.

That slide, along with rekindled investor concerns over further potential interest rate hikes from the US Federal Reserve, also saw the miner's stock take a hit in US markets, where it's also listed. The BHP share price closed down 2.5% on the New York Stock Exchange overnight.

The iron ore price has been holding up far better than most analysts had forecast for Q4. But the overnight retrace looks to be spooking investors today.

This looks to be driven by ongoing weakness in the Chinese economy. The latest trade data from China, the top export market for Australia's iron ore, revealed a 6.4% decline in overseas shipments, below consensus expectations.

Commenting on the Chinese trade data, Fiona Cincotta, senior financial markets analyst at City Index said (quoted by The Australian Financial Review), "The data signals the continued decline in the Chinese economic outlook driven by deteriorating demand in the country's largest export destination: the West."

What's ahead for the BHP share price?

Investors may be jittery on the Chinese trade data and the resulting dip in the iron ore price, but according to Goldman Sachs, the industrial metal is primed for a move higher.

In what would offer some helpful tailwinds for the BHP share price, Goldman Sachs metals analyst Nicholas Snowdon just lifted his three-month target for the iron ore price to US$130 per tonne.

"The path into 2024 now points to a balanced market versus previous surplus, suggesting no imminent glut risk ahead," Snowdon said.