ASX mining shares are notoriously cyclical because global commodity prices are beyond the control of companies.

However, that does mean you could make some money if you can invest near the bottom of the said cycle.

Two particular resource stocks rose nicely last month, which the team at Celeste Funds reckons is just the start of an upward swing:

'Significant growth optionality'

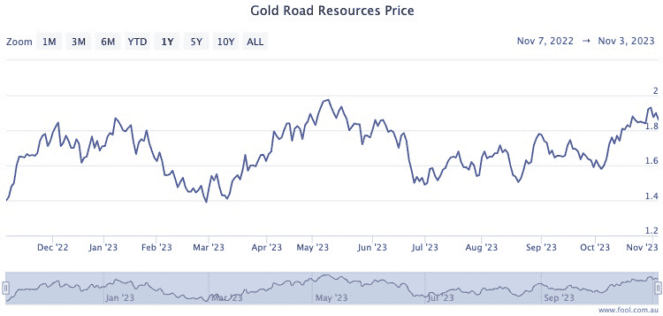

Gold Road Resources Ltd (ASX: GOR) shares rocketed 17% in October after the company did everything under its control to lift its value.

The Celeste analysts, in a memo to clients, pointed out how its Gruyere mine went gangbusters last quarter.

"Gruyere produced a record 89k ounces of gold (100% basis) at an all-in sustaining cost of AU$1,682 per ounce, generating free cash flow of $52 million, which was up from $30 million in the June quarter."

Gold Road is something of a darling among professional investors at the moment.

CMC Markets currently shows nine out of 14 analysts rating the stock as a strong buy.

"Gruyere remains a tier-1 asset, providing low-cost and low-risk exposure to gold," read the Celeste memo.

"Moreover, Gold Road's 19.9% stake in De Grey Mining Limited (ASX: DEG) delivers significant growth optionality."

'Rising global demand for 'green' steel'

The Champion Iron Ltd (ASX: CIA) share price also enjoyed a strong October off its latest quarterly update, rising 13%.

"Bloom Lake produced a record 3.4Mwmt of high-grade iron ore concentrate with the phase 2 expansion reaching nameplate capacity post-quarter end."

There are several projects underway making good progress, which could become catalysts for the mining stock.

"The DRPF project remains on track with final investment decision expected shortly, while the feasibility study for the Kami project is expected to be completed by early next year," read the memo.

"We remain attracted to CIA's growth prospects and their exposure to rising global demand for 'green' steel."

Champion Iron also enjoys excellent support among Celeste's peers. According to CMC Markets, all seven analysts covering the mining shares reckon it's a buy, with six of them rating it a strong buy.