The impact of 12 interest rate rises in quick succession means that most sectors are in some sort of distress.

So which industries present the best potential payoff for investors willing to buy in now?

The team at Market Matters had an idea:

The ASX sector just waiting to bounce back

Real estate is arguably the sector that's most directly influenced by interest rates and bond yields.

As such, it's had a rough run this year.

"The local sector is down close to 5% in 2023, while the US equivalent has plunged over 38% from its early 2022 high, less than two years ago," Shaw and Partners portfolio manager James Gerrish said on Market Matters.

But Gerrish's team reckons it could be ready to fight back.

"Post-COVID we've seen some tremendous returns from battered sectors when the dial finally turned, with tech, coal and gold all coming to mind," said Gerrish.

"We believe the property sector could be throwing its hat into the proverbial ring as the next candidate."

Perhaps with easing bond yields and plateauing interest rates to look forward to, Gerrish's analysts are "bullish" for real estate.

"We like the risk/reward towards the property sector with a bounce towards [15% to 20%] looking realistic," he said.

"If rates have finished rising, as we think they have, this creates an exciting prospect for the battered-up real estate names."

So which ASX 200 shares specifically do Gerrish's analysts like from this industry?

They named four to consider:

Two ASX 200 stocks for growth

The team is bullish on REA Group Ltd (ASX: REA) as it advantageously has a foot each in two different camps.

"REA is correlated to both the real estate and tech sectors, a great combination at this stage of the cycle."

The share price has cooled off 13% within October but has rallied in recent days for an 8.3% revival.

"We can see REA testing the $170 to $180 area into 2024, or ~15% higher."

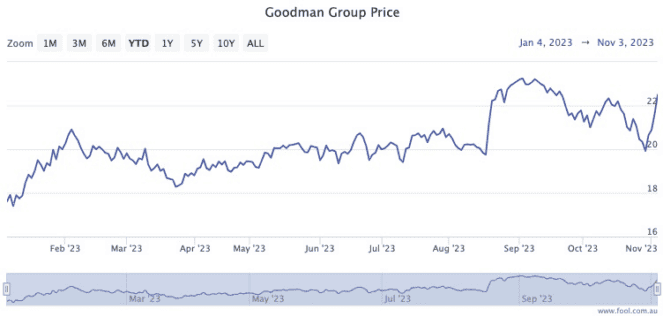

Meanwhile, the Market Matters team actually bought Goodman Group (ASX: GMG) in recent days to take advantage of retreating bond yields.

"Almost on cue, Jerome Powell has ignited the sector, sending our new purchase to surge +9.5% from its lows – we wish all positions started off this well!"

And two stocks for income (and maybe growth)

On the income side, the analysts' pick is Dexus (ASX: DXS).

Only a few days ago, the stock price for the office property trust hit lows it hasn't seen since 2014.

"Dexus has struggled over recent years, although its large dividends have helped cushion the decline – it is forecast to yield ~8% over the next 12 months."

Similar to REA and Goodman, the Dexus share price has also seen a 9.3% revival in the last few days.

"There remains plenty of work to do at Dexus as it continues the AMP Ltd (ASX: AMP) integration while grappling with mixed demand for office, but a turn in the property market can only help the process."

For a higher risk-reward buy that could provide both capital growth and income, Gerrish's team have their eyes on Centuria Capital Group (ASX: CNI).

"Centuria Capital Group [is] one of the most leveraged 'plays' on interest rates given they have less interest rate hedging in place — a double-edged sword that has clearly worked against them."

The idea is that Centuria's fortunes could roar back in a hurry when the macroeconomics turns around.

"If bond yields/interest rates have indeed peaked, their FY24 guidance may prove conservative, allowing plenty of room for a snapback after such dire price action."

And there is excellent income to sustain investors until the turnaround.

"Centuria Capital is forecast to yield more than 9% plus some franking over the next 12 months, a good return if the stock just treads water."

The team reckons there could be up to 25% upside for Centuria shares in the coming months.