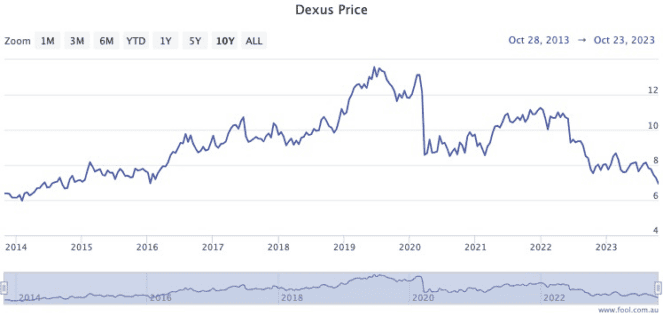

It's a depressing time for investors in one S&P/ASX 200 Index (ASX: XJO) stock on Wednesday as it plunged to lows not seen for nine years.

Office real estate company Dexus (ASX: DXS) is seeing its share price plunge 4% at the time of writing on Wednesday afternoon.

During the day the ASX 200 stock set not just a new 52-week low, but stumbled down to a level that it last experienced way back in the middle of 2014.

So what's happening with this real estate investment trust (REIT)?

It seems there were multiple factors bearing down on the business:

CEO departing after 11 years in charge

The most obvious catalyst was that Dexus chief executive Darren Steinberg is exiting after 11 years in the role.

He will depart next year after a replacement has been found and briefed.

"Dexus has a team of experienced and talented people and I will leave knowing that the business is in a strong position to continue to deliver long-term value," said Steinberg.

"I am proud of everything we have achieved as a team for our investors, our customers and our people, and am committed to ensuring a smooth transition."

Office vacancies increase

The second trigger for the ASX 200 stock's fall from grace could have been a performance update from the company on Wednesday morning.

The report showed both occupancy by income and occupancy by area for its office properties had dropped for the September quarter.

It seems the post-COVID change in white collar workers' commuting habits is still a headwind.

"Dexus's office portfolio occupancy by income reduced slightly to 94.7%, primarily driven by vacancy in three Sydney assets located in fringe markets and outside the CBD core."

Interest rates will likely move up (again)

A third reason may be the higher-than-expected inflation figure for Australia also revealed on Wednesday.

This strengthens the case for an interest rate hike on Melbourne Cup day, which is always poison for the real estate sector.

eToro market analyst Josh Gilbert said the surprising inflation numbers "will undoubtedly move the dial for the Reserve Bank".

"This print, alongside a labour market that remains extremely tight, piles the pressure on the RBA to put its foot back on the gas and hike interest rates again."