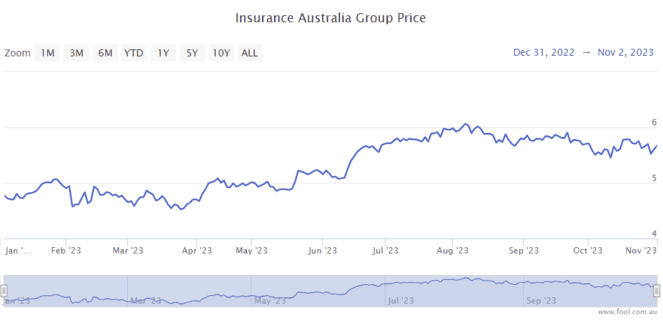

The Insurance Australia Group Ltd (ASX: IAG) share price has lifted quite strongly in 2023 to date, up by around 25%, as we can see on the chart below.

This insurance business is one of the big two players in Australia, alongside Suncorp Group Ltd (ASX: SUN).

Why has the IAG share price been rising?

The same thing that has helped the company in 2023 to date may also help the business during FY24.

Inflation isn't ideal for most households and businesses, but it is arguably helping this insurance giant.

Higher premiums boost the company's gross written premium (GWP) revenue and may help net profit after tax (NPAT).

The Reserve Bank of Australia (RBA) has been raising interest rates in a bid to reduce the amount of economic demand in Australia. Higher interest rates also mean that IAG can earn stronger returns on its investment portfolio (particularly bonds).

In FY23, its GWP grew 10.6% to $14.7 billion, while NPAT increased 140% to $832 million.

Despite increasing insurance premiums, IAG boasted a high level of customer retention as well as growth of new customers. It added approximately 132,000 customers to its direct insurance Australia business in FY23.

It expects to achieve 'low double-digit' GWP growth in FY24, and its guided reported insurance margin ranges between 13.5% to 15.5%. However, inflation is hurting on the motor claims costs side.

Another benefit is that the weather pattern affecting Australia has changed from La Nina (wetter) to El Nino (drier). IAG said it experienced a "relatively benign" start to FY24 from a natural perils perspective, with costs of $120 million which includes $47 million in additional claims from events in FY23. Less costs would be helpful to IAG shares if that continues.

ASIC proceedings

On 25 August 2023, IAG announced that the consumer watchdog, the Australian Competition and Consumer Commission (ACCC), was commencing legal proceedings against the company. These related to the pricing of and disclosures about how premiums were priced for renewing customers of SGIO, SGIC and RACV home insurance products.

IAG intends to defend the proceedings, saying that it had delivered on loyalty promises made to customers and did not mislead customers about the extent of the discounts they would receive.

This cloud may hang over the IAG share price while proceedings continue.

Is the IAG share price a buy?

The broker UBS certainly doesn't think so. It has a sell rating on the company.

UBS has a price target on the business of $5.10, which implies a fall of around 12% over the next year for the IAG share price. The broker said that IAG's potential loss from the proceedings have not been quantified, and no provision is held.

UBS thinks the market now anticipates the conditions and the FY24 first half could be disappointing if the result doesn't "step up sharply." At the time of the UBS note, it suggested there were cheaper valuations with less earnings risk in other insurer names on the ASX.