As most investors would be aware, the past few weeks have given the Australian share market a big shakedown. Since the middle of September, the All Ordinaries Index (ASX: XAO) has lost a horrid 6.3%. But rather than despairing, or worse, selling out of my stocks, I've been trying to use this volatility to my advantage by picking up a new All Ords share.

One of my freshest positions is in one All Ords stock called Plato Income Maximiser Ltd (ASX: PL8). Why Plato? Because I am expecting monstrous dividend income from this investment going forward.

Plato Income Maximiser is a listed investment company (LIC) whose primary aim is (as the name suggests) to maximise fully-franked dividend income for its investors.

To do so, the LIC holds a portfolio of diverse dividend-paying ASX shares.

As of September, some of Plato's top holdings included (in no particular order):

- BHP Group Ltd (ASX: BHP),

- Woodside Energy Group Ltd (ASX: WDS)

- National Australia Bank Ltd (ASX: NAB)

- QBE Insurance Group Ltd (ASX: QBE)

- Metcash Corporation Ltd (ASX: MTS)

- Ampol Ltd (ASX: ALD)

- New Hope Corporation Limited (ASX: NHC)

Why did I buy this All Ords share for my ASX portfolio?

So why Plato out of all the All Ords shares out there? Well, as I mentioned earlier, I'm expecting big dividends from this investment. At present, Plato shares offer a fully-franked trailing yield of 5.69%. What's more exciting, though, is that this company is one of the few ASX shares that doles out monthly dividends.

Thus, I'm looking forward to having a steady and predictable stream of passive income, continually pouring more cash and franking credits into my portfolio going forward.

However, there are many All Ords shares on the ASX that prioritise dividend income at the expense of overall performances, all whilst charging outsized management fees. Names like WAM Capital Ltd (ASX: WAM) and WAM Research Ltd (ASX: WAX) come to mind.

Luckily, Plato doesn't fall into that category, in my view. I think its management fee of 0.8% per annum is reasonable, considering the LIC's active management and monthly dividend schedule.

Further, Plato Income Maximiser has a decent performance track record to boast of. As of 30 September, investors have enjoyed a total shareholder return (including dividends and franking) of 8.7% per annum since the LIC's inception in April 2017. That beats out its benchmark S&P/ASX 200 Franking Credit Adjusted Daily Total Return Index, which has delivered 7.6% per annum over the same period.

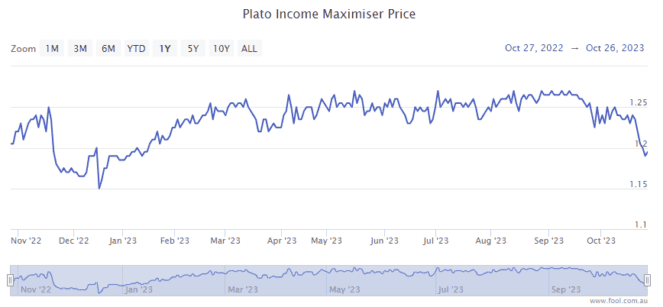

So all in all, I was happy to pick up this income-focused All Ords share at what I thought was a reasonable price. I'm now looking forward to receiving monthly dividend paycheques going forward.