A passive income of $200 each week for the rest of your life would be pretty handy for most Australians, but it's not such an outlandish dream.

In fact, it's very achievable if you can commit to chipping in just $5 each day.

That's the price of a cup of espresso!

The secret is to use the power of compounding and ASX shares. Let's examine one scenario of how you can get yourself to $200 a week of extra income:

Explosive growth + compounding = smiles

Comparison site Finder conducted research that found the average Australian had $39,459 saved in their bank account.

So let's start with that.

If you can invest that sum into a portfolio of diversified ASX shares, you are on your way.

My preferred path would be to buy growth shares, in order to focus on capital growth without the tax hassle of having to reinvest dividends.

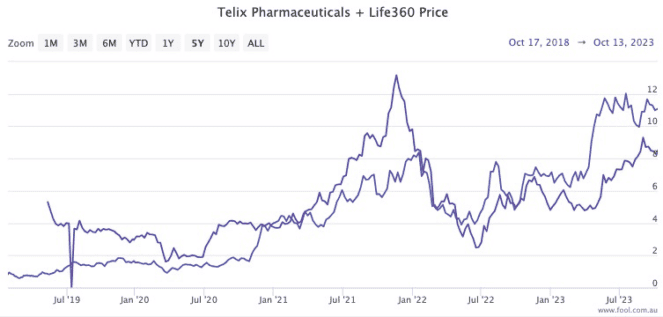

A couple of great examples of such stocks are Life360 Inc (ASX: 360) and Telix Pharmaceuticals Ltd (ASX: TLX).

Both businesses are fairly young in terms of the business life cycle, allowing them plenty of room to expand in the coming years.

Life360 is a software company that makes family safety apps for the US market.

The Californian company has been lauded for transforming itself from a cash-burning startup to heading towards break-even — or even a profit — in the coming period.

The Life360 share price has risen 55.5% since its closing day on the ASX in May 2019. That's despite experiencing a horrific 82% dip during the growth sell off between November 2021 and June 2022.

The gains over those 4.5 years equate to about 10.3% compound annual growth rate (CAGR).

Telix, meanwhile, is in the business of developing cancer diagnostic and treatment solutions.

The Australian company released its first product into the commercial market last year, and it has been a darling for investors since.

In fact, the stock has almost risen 1,000% over the past five years.

That's a mind-blowing CAGR of 61.5%!

First way to get your hands on passive income

Realistically, not every stock in your portfolio will end up a Telix.

So let's say you can rake in 10% of CAGR each year. I think that's doable with a mixture of Telixes, Life360s and a few bombs.

Starting with a $39,459 portfolio, then putting in $5 a day — rounded to $150 each month — will take you to $105,168 by the end of eight years.

Not bad, hey?

From this point on, we can think about our goal of cashing in $200 each and every week.

There are a couple of ways an investor can generate passive income.

The simple route is to just sell off the gains each year.

If our portfolio can maintain the 10% CAGR, that's $10,516 of new cash annually, equating to $202 of income each week. Mission accomplished!

While that's the simple route, the passive income could be volatile.

We all know share markets can fluctuate. Even through a long-term CAGR of 10%, there will be some years when there are no returns and even some years when you lose money.

So if this unpredictability doesn't sit right with you, there's an alternative.

An alternative way to harvest income

The second method is to sell all the growth shares and then reconstruct the portfolio with ASX dividend shares.

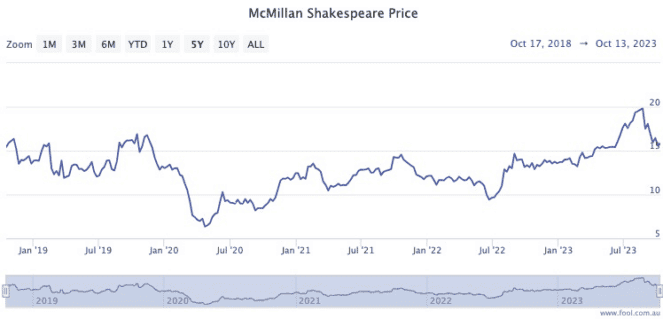

Again, you'll want to diversify. A pair of decent examples that come to my mind are NRW Holdings Limited (ASX: NWH) and McMillan Shakespeare Ltd (ASX: MMS).

NRW provides contracting services for mining and construction clients.

It's a way of getting exposure to the resources sector, without being fully vulnerable to the cyclical nature of each commodity.

The stock is currently paying out a dividend yield of 6.1%, fully franked.

McMillan Shakespeare sounds like a law firm, but it's an employee benefits provider. On behalf of its corporate clients, it takes care of services like salary packaging and car leasing.

At the moment it's providing a 7.9% fully franked dividend yield.

So with distributions from shares like these plus a small amount of capital growth each year, the new portfolio can pay out 10% CAGR, just like in the first method.

And, historically, dividends have been more stable than the volatility seen in valuations.

The downside with this route is that selling all the growth shares could trigger capital gains tax. So you'll want to seek personal advice when choosing the best method for you.