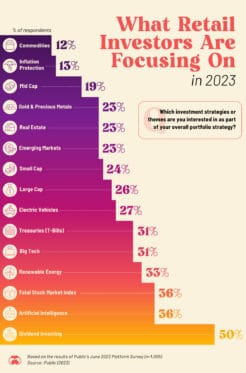

So, after rampant post-COVID inflation, 12 interest rate rises, and a war in Europe, what exactly are stock investors looking for right now?

Online investing platform Public recently posed precisely this question to its investors.

The aggregated results published on Visual Capitalist provide a fascinating insight into the mindset of your fellow stock investors at the moment.

While this was a US study, American and Australian share market behaviours have always displayed many similarities and correlations.

Let's check out where the money is flowing to:

1. Dividend investing

In times of rising interest rates and gloomy economic outlook, investors take shelter in stocks that produce dividends.

The idea is that anaemic capital growth could be compensated by regular cash distributions.

Therefore it's not a massive surprise that 50% of investors were looking for income-producing opportunities.

It was a clear winner in the survey.

2. Artificial intelligence

ChatGPT's public release late last year triggered a storm of hype and debate regarding the role of artificial intelligence in the economy.

Almost a year later, investors are still excited by shares associated with the technology.

"The hype around AI hasn't faded, with 36% of the respondents saying they'd be interested in investing in the theme — including juggernaut chipmaker Nvidia Corp (NASDAQ: NVDA)," said Visual Capitalist finance writer Marcus Lu.

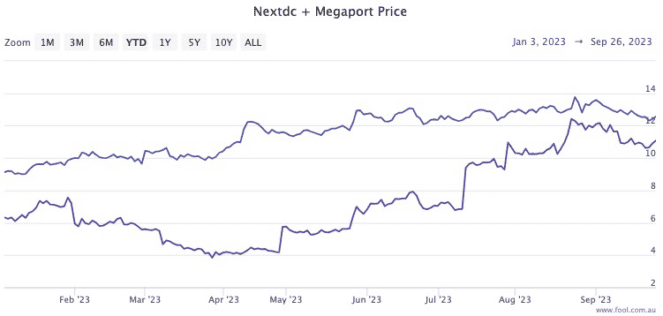

Earlier this week, Wilson Asset Management portfolio manager Tobias Yao presented a couple of ASX 200 shares as local examples of shrewd AI investments: NextDC Ltd (ASX: NXT) and Megaport Ltd (ASX: MP1).

"We are taking a positive view to AI-exposed companies given our observations that there is real evidence that AI initiatives are driving efficiency gains in different industries," he said in a memo to clients.

"The positive narratives coming out of the world's leading technology companies suggest that investment into this space should continue over the next few years, and we want to be positioned accordingly."

3. Total stock market index

Remarkably, tied for second with 36% of investors going for the strategy, are passive index funds.

Similar to frontrunner dividend investing, this could be a result of all the turbulence felt in markets over the past two years.

As celebrity investor Warren Buffet once said: "A low-cost index fund is the most sensible equity investment for the great majority of investors."