Wesfarmers Ltd (ASX: WES) shares are bucking the wider selling trend today.

At time of writing, the S&P/ASX 200 Index (ASX: XJO) retail share is trading for $53.37. That's up 0.3% from Friday's closing price of $53.23 a share.

For some context, the ASX 200 is down 0.3% at this same time.

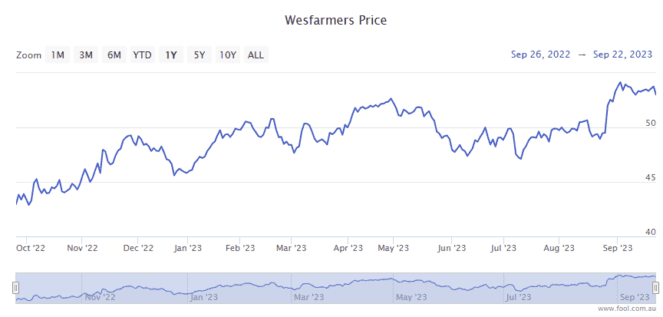

As you can see in the above chart, Wesfarmers shares have been strong performers over the past 12 months, gaining 21%. And that doesn't include the full-year dividend payout of $1.91 per share, fully franked.

Wesfarmers reported its full-year results on 25 August. Highlights included an 18.2% year increase in revenue, which reached $43.5 billion. And net profit after tax (NPAT) increased 4.8% from FY22 to $2.47 billion. And the dividends mentioned above were up 6.1% from the dividends paid out in FY22.

That's undeniably a solid year for Wesfarmers shares, which encompass a range of subsidiaries including Bunnings, Kmart, Officeworks, Priceline, and Target.

But looking to the year ahead, Wilsons Asset Management (WAM) sees some headwinds brewing.

Why could Wesfarmers shares be facing headwinds?

WAM expressed particular concerns over the impact of mounting labour costs on some companies.

According to Matthew Haupt, lead portfolio manager at WAM Leaders:

Cost inflation was a hallmark of the most recent local earnings season as higher labour, rent, energy and transport costs become increasingly baked into corporate earnings, all but ensuring margin compression over the next 12 months.

The fund manager is "particularly cautious about companies that have higher labour expenses as a proportion of their total cost base".

That could put Wesfarmers shares under selling pressure unless the company is able to make some sizeable labour cuts.

"Unless those firms can dramatically reduce head count, the soaring cost of labour is an impost they will be unable to offset," Haupt said.

Noting that FY23 saw some strong results from some of the companies that fall into this category, Haupt said, "We are yet to see the full impact of wage inflation hit company earnings."

It's not just Wesfarmers shares that could struggle, with the fund manager pointing to several other ASX 200 retail stocks with intensive labour costs:

"Wesfarmers, Woolworths Group Ltd (ASX: WOW) and Coles Group Ltd (ASX: COL) are all facing significant wage inflation on labour-heavy cost bases," Haupt said.

Hence the potential margin compression.

"In a slowing revenue environment, it becomes particularly challenging to maintain profit margins," Haupt concluded.