Can you manage to save $5 each day to invest?

That's less than the price of a cup of fancy coffee, or a standard beer at the pub.

If you can set aside a fiver everyday, I can show you how you can build up an ASX shares portfolio that will pay you out a nice passive income.

Yes, that's money coming in for doing nothing.

For the rest of your life.

How good!

Let your savings grow for a decade

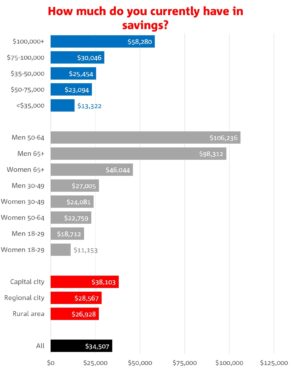

According to a National Australia Bank Ltd (ASX: NAB) study, the average Australian has $34,507 of savings.

Let's assume you're worse than average, and round that down to $30,000.

While history is never an indicator of future performance, there are some exchange-traded funds that have doubled their share price over the past five years.

One example is Vaneck Morningstar Wide Moat Etf (ASX: MOAT), which holds a basket of US companies with quantifiable competitive advantages.

If you can buy into one of these ETFs with your $30,000, or buy a varied portfolio of ASX shares that perform similarly, you are on your way.

According to the government's MoneySmart calculator, if you keep adding $5 each day to that investment, it will grow to $173,000 after 10 years.

First step complete.

…then rake in the passive income!

The next stage is to convert this investment into one that will provide you a reasonable income.

The ASX is fortunate to list stocks with very decent dividend yields. This is because of Australian tax laws that are favourable to paying out dividends as opposed to other ways of returning capital to investors, such as buybacks.

Currently there are some reputable ASX shares in the S&P/ASX 200 Index (ASX: XJO) that are paying out yields in excess of 8%. Examples include BHP Group Ltd (ASX: BHP), JB Hi-Fi Limited (ASX: JBH) and Bank of Queensland Ltd (ASX: BOQ).

Let's say that you managed to buy a portfolio of income stocks that, in total, pay out 8% each year in dividends.

Then your $173,000 nest egg will provide you a passive income of $13,840 each year.

With franking, the end amount you receive could be even greater.

Well done, put your feet up.