Let's get this out of the way. There is no such thing as 'safe income' on the share market. No ASX 200 dividend stock is obligated to pay out a certain level of dividend income every year to its investors. Or any income for that matter. As such, no ASX investors should expect uninterrupted income in perpetuity from any ASX dividend share.

But that doesn't mean we can't get close. There is one ASX 200 dividend stock on the share market that has an unrivalled 22-year streak (and counting) of raising its annual dividend. That's about as safe as you can get on the ASX.

The past 22 years have thrown up a lot of challenges for any company. There was the dot-com bust of the early 2000s, of course. Not to mention the global financial crisis of 2007-2009, and the COVID pandemic.

As such, not many ASX shares were able to keep their dividends flowing, and increasing, over this period. But Washington H. Soul Pattinson and Co Ltd (ASX: SOL) did.

An ASX 200 stock with a 22-year dividend streak

Soul Patts is a diversified investment house with deep ASX roots. It was founded back in the late 1800s as a chain of pharmacies. But today, this company functions more like a managed fund than a company. It owns a massive portfolio of diversified assets, which it manages on behalf of its investors.

These include large chunks of ASX 200 stocks Brickworks Ltd (ASX: BKW), New Hope Corporation Limited (ASX: NHC) and TPG Telecom Ltd (ASX: TPG). Soul Patts also owns a large portfolio of diversified blue chip shares, thanks to its acquisition of Milton Corporation a couple of years ago.

In addition to this formidable portfolio of ASX 200 stocks, Soul Patts also owns a growing portfolio of private assets. These include farmland, private credit and private equity.

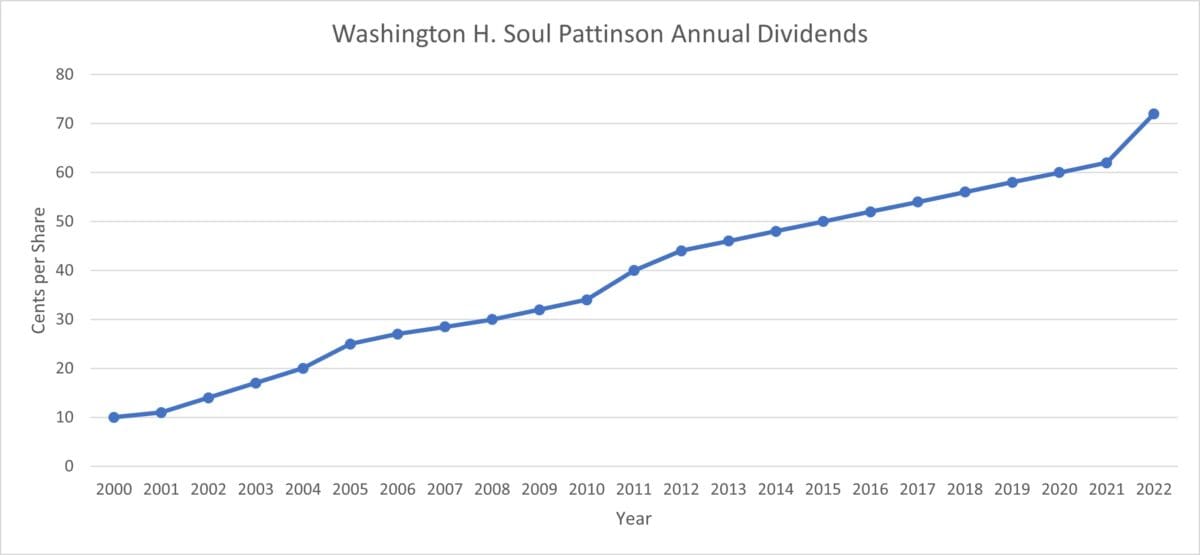

But let's get to the dividends. So as we previously flagged, Soul Patts has a spectacular 22-year-and-counting streak of increasing its dividends annually. You can see this visualised below:

As we discussed earlier this week, buying Soul Patts shares in the year 2000 would have gotten an investor an initial dividend yield of 3.59%. But if that investor held onto their shares until 2022, they would be getting an annual yield of 22.32% on their original investment – compounding in action. That's the financial firepower that these annual dividend increases give shareholders.

So if you want safe dividend income on the ASX, well, as much safety as the ASX can give, this stock might just be your best bet.