Many of the most impactful risks tied to investing in publicly listed companies are on full display. Whether it is an unprofitable business model, a questionable balance sheet, or a declining market share, these are all obvious areas to evaluate an ASX stock.

One less obvious metric that rarely receives the attention it deserves is the company's share count. Not just the present number of shares outstanding, but the evolution over the past five to 10 years. Has it dramatically increased, or has it been kept on the straight and narrow?

The danger of shareholder dilution can have disastrous consequences for long-term investors.

How does it quietly consume wealth?

Fractional ownership of a company is only possible through the use of shares.

They are a claim to a piece of the business, allowing numerous shareholders to reap the rewards of its future success. The more shares you own, the bigger the claim to future earnings.

The total number of shares in a company can change over time as needed. For example, an ASX-listed company might issue additional stock to raise capital. Or, additional shares might be created by incentivising employees with stock-based compensation.

This can be worrisome for those already invested.

Like enjoying a bottle of red among friends… if another glass turns up, that means less red going into yours. Another five? Well, it might more closely resemble a shot.

Now imagine the glasses are the number of shares on issue and the wine is company earnings — that's dilution!

If an ASX stock you own continuously increases the share count over time, your share of earnings will grow smaller and smaller. And, where earnings per share (EPS) goes, the share price will eventually be sure to follow.

The only way a higher share count can be negated — without buying more shares — is for the company to grow earnings above the rate of dilution.

Beware the serial diluter

Avoiding every company that increases its share count is not the answer. There are situations where issuing new shares is necessary. What matters is whether it is being done in a sustainable and shareholder-friendly way.

It all comes down to the capital allocation of the management team. Opportunities will arise when diluting shareholders by 3% might be worthwhile. If an acquisition can deliver 5% earnings growth, a 3% dilution could be justifiable.

The real wealth destroyer is when new shares are issued and EPS growth doesn't eventuate. Worst still… earnings decline. In that scenario, there are more wine glasses and less wine to go around — devastating!

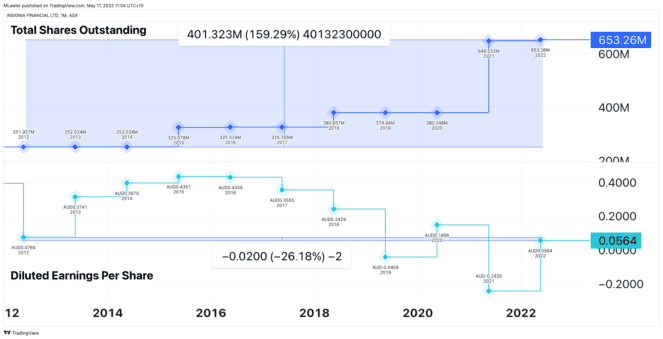

Take Insignia Financial Ltd (ASX: IFL) for instance. The total number of shares on issue in this ASX stock has more than doubled over the past 10 years. Whereas diluted EPS has decreased by roughly a quarter, as shown above.

In 2017, Insignia (known as IOOF at the time), made an enormous acquisition for nearly $1 billion. Much of the bill was footed by shareholders through the issuing of more shares.

It turns out the deal wasn't as sweet as what was possibly hoped, with earnings failing to even offset the dilution.

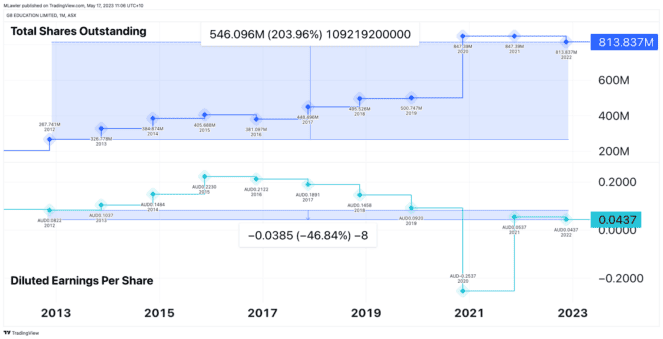

A more exaggerated example is G8 Education Ltd (ASX: GEM). This ASX stock has tripled the number of shares on issue over the past decade. In return, profits have almost halved compared to 10 years ago.

Most of the dilution came about during the pandemic. However, the trend was present well before lockdowns were a thing.

Over time, the share price bears the consequences of this unruly dilution. Today, Insignia Financial and G8 Education have share prices 50% and 63% lower than where they were in 2013.

What to look for in quality ASX stocks?

The impact of severe shareholder dilution slowly chips away at a portfolio. Fortunately, there are a few traits to look for to dodge this dastardly wealth demise.

Firstly, ASX companies with strong balance sheets are a good place to start. There's less chance of significant dilution if a business has plenty of cash and minimal debt. This is because the company can fund growth initiatives through its own capital, rather than by diluting yours.

Secondly, seek out companies with a history of minimal, or no, increases in share count. It depends, but 0% to 3% dilution per year is generally acceptable.

Finally, the holy grail… find ASX stocks that decrease the number of shares over time. Typically these are profitable companies with healthy balance sheets, able to conduct share buybacks. By buying back stock, your cut of earnings is increased.