On 29 December 2022, I named what I believed were the best Australian companies to invest in for the year ahead. One share mentioned was S&P/ASX 300 Index (ASX: XKO) constituent Codan Limited (ASX: CDA).

Since then, shares in the supplier of communications and metal detection equipment have performed tremendously. As a matter of fact, Codan is the fourth best-performing ASX 300 share in 2023 — returning 76% so far this year, as shown in the chart below.

Why am I telling you this? Not to skite, demonstrate my crystal ball prowess, and stroke my ego. There is no intellectual gain from such practices. As the late John Kenneth Galbraith said, "There are two kinds of forecasters: those who don't know, and those who don't know they don't know."

No, instead of meaninglessly celebrating the short-term returns, let's put Codan up on the hoist again and reassess. Could it still be a worthwhile investment after sprinting to nearly $7 per share? Is the risk to reward still appealing? What is ultimately my five-year price target on this ASX 300 share?

Let's not waste any time.

Do I still think Codan shares can beat the market?

The Codan share price was heavily sold off in the second half of 2022 amid fears of falling metal detector demand and lower forward guidance.

As it turns out, metal detection revenue dropped 46.4% to $73. 8 million in the first half of FY23 compared to the prior corresponding period. Likewise, the company's net profit after tax (NPAT) slid 38.5% to $30.8 million.

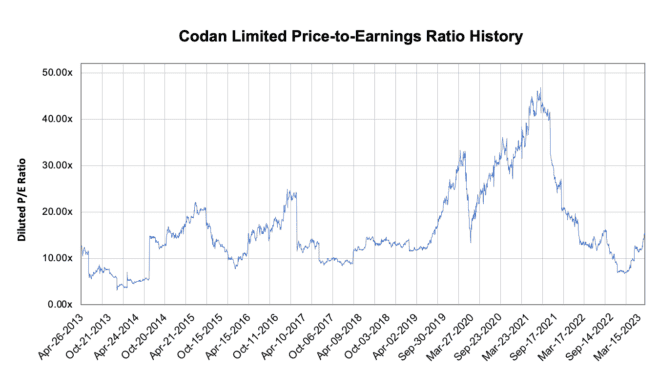

However, the response by the market led to the lowest price-to-earnings (P/E) ratio that Codan has traded on since 2014. As shown below, the ASX 300 share could be purchased for under seven times earnings in December 2023.

Jumping back to the present, the momentum has shifted in 2023.

Whether investors are expecting stronger Minelab sales amid a resurgence in the gold price, or increased defence spending is being viewed as a positive for the communications segment, the market has been happy to bid Codan shares back up to a 15 times earnings multiple.

In my opinion, I think Codan remains a high-quality business with growth potential. The Minelab brand is incredibly strong with patented technology, while the communications segment provides a sticky revenue stream.

These facets combined, I remain confident the company can achieve a top-line 15% compound annual growth rate (CAGR) over the next five years. Ultimately, this places my five-year price target at $14.90 — 114% above the current price of this ASX 300 share.

Comms could crack this ASX 300 share

Codan, as with any opportunity, is not without its risks. In my view, the communications division poses the greatest threat to achieving benchmark outperformance in the medium to long term. Allow me to explain.

Unlike Minelab, it is difficult to tell how much of a competitive advantage Codan's various communication products hold. The segment as a whole is fairly opaque with regard to contract details, product specifications, and technology developments.

The company has purposefully pushed comms to be a bigger part of the business. Given its lack of transparency, this presents a risk of being blindsided.

Furthermore, the exposure to defence can be hit and miss. Take it from me, as a previous Electro Optic Systems Holdings Ltd (ASX: EOS) shareholder. If the pipeline begins to dry up, this segment can quickly turn into a money drainer, rather than a maker.

Final takeaway

At this stage, I still think Codan shares make for an appealing long-term hold. Though, I'm yet to take my own advice and buy into this ASX 300 share myself.

However, if the company's next update shows the company has performed resiliently in this difficult environment, I'd be inclined to pull the trigger around the current price. I believe there is a high level of longevity in this company that the broader market is discrediting.