Growing shareholder wealth by 50 times in a single lifetime is something very few listed companies can attest to. Believe it or not, ASX healthcare share Pro Medicus Limited (ASX: PME) has achieved this since listing back in the year 2000.

Fast forward to the past year, and the medical imaging software company is still putting the S&P/ASX 200 Index (ASX: XJO) to shame. Shares in the ASX 200 member have flown 27.2% higher, while the benchmark has climbed a lesser 5.5%.

Nevertheless, let's put the past in the past and focus on what matters most… the future. Assigned with painting the possible path forward, two of our writers have gone to town on whether investing now in Pro Medicus shares makes sense.

Priced to perfection despite a huge rise in interest rates

By Tristan Harrison: Pro Medicus is one of the best businesses on the ASX, in my opinion. Clients seem to love the software offering, it has excellent margins, and recent contract wins have been impressive. I wish I'd bought it a while ago.

Having said that, however, I think a company's valuation can be a major risk to the investment case. As investors, we're trying to buy a piece of the profit/cash flow for a price that will reward us in the future.

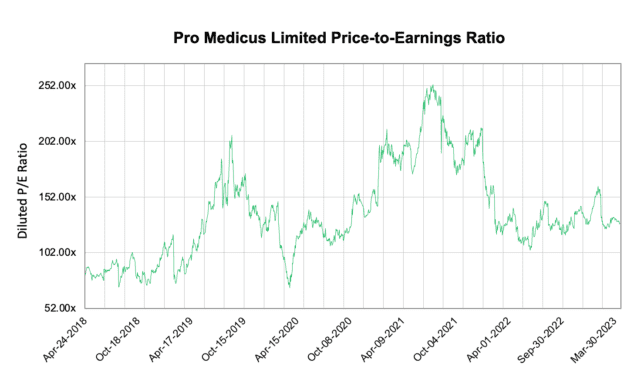

According to Commsec, Pro Medicus could generate 55.5 cents of earnings per share (EPS) in FY23 and 87.6 cents in FY25. This would put its share price at 113x FY23 and 71x FY25's estimated earnings.

In a low-interest environment, those would be pricey valuation numbers. Interest rates have shot higher, yet the Pro Medicus share price is where it was at the end of 2021.

But other high-quality ASX shares have fallen hard. Shares in Xero Limited (ASX: XRO), for example, have plunged 35% over the same period, while the Altium Limited (ASX: ALU) share price is down 15% since December 2021.

Arguably, I don't think the Pro Medicus share price reflects the higher interest rate considering how much growth is priced in.

While I believe the business has a very promising future, there is little room for error when it comes to the share price. That may mean that anything less than perfection is treated harshly by investors. Future success is not guaranteed.

With Pro Medicus having such high profit margins, it could attract competition from other software providers over time, which could slow growth or mean that clients are considering price comparisons. I think this would be bad news for Pro Medicus' longer-term growth prospects.

Motley Fool contributor Tristan Harrison does not own shares in Pro Medicus Limited and owns shares in Altium Limited.

What are the bears overlooking in Pro Medicus shares?

By Mitchell Lawler: Let's address the elephant in the room… there's no denying that Pro Medicus looks expensive at an earnings multiple of around 130 times. For comparison, the average price-to-earnings (P/E) ratio for the global healthcare services industry is approximately 39 times.

However, Pro Medicus is not your average healthcare services company. Scratch that… Pro Medicus is not your average company, period. When it comes to earnings growth and return on capital, the medical imaging software provider ranks among the top tier — both locally and against US-listed businesses.

Over the past five years, earnings per share have grown at a compound annual growth rate (CAGR) of 45.6% — the ninth highest of all ASX and US-listed companies. Furthermore, its return on capital of 40.7% places it as the 24th most efficient with capital — making it a truly world-class company.

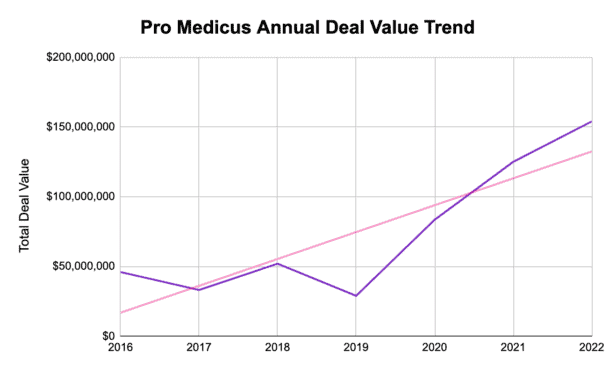

Based on the attractive unit economics of Pro Medicus' software product, earnings should be able to grow faster than revenue. As such, the all-important metric for the company's future success is the number of customer deals and deal size.

Historically, the annual value of total deals (in dollar terms) with healthcare groups has followed an upward trajectory of 22% growth per annum, as pictured above.

I believe there is the possibility of Pro Medicus accelerating beyond this rate over the coming five years if it can negotiate contract renewals at an enlarged deal size while also adding new customers.

On top of this, the company has yet to meaningfully develop its presence in the European market, offering another avenue of growth once established.

Lastly, Pro Medicus has built up a sizeable war chest of cash in recent years. The amount tallied up to $94.2 million at the end of 2022.

Although the company's thick margins are surely attracting competition, its balance sheet should give it the option to either invest in maintaining its leadership or acquire upcoming competitors.

Motley Fool contributor Mitchell Lawler owns shares in Pro Medicus Limited.