The Kogan.com Ltd (ASX: KGN) share price is racing higher following the company's latest business update.

Shares in the online retailer are up 10% to $3.98 in Wednesday morning trade. The positive move comes amid the company's plans to conduct a share buyback as its balance sheet returns to a healthy state.

Putting spare cash to work

The market is looking upon Kogan fondly this morning as the ship veers closer to its originally charted course. After fiercely focusing on right-sizing inventory levels and returning to underlying profitability, shareholders who have stuck it out are being rewarded.

Announced in its third-quarter update, management has made the decision to return capital via a share buyback. The decision comes as inventory levels further decrease to $78.3 million at the end of March, while net cash settled at $49.1 million.

Furthermore, the update revealed that all debt within Kogan had been repaid, with only a small advance on the books of its Mighty Ape operations.

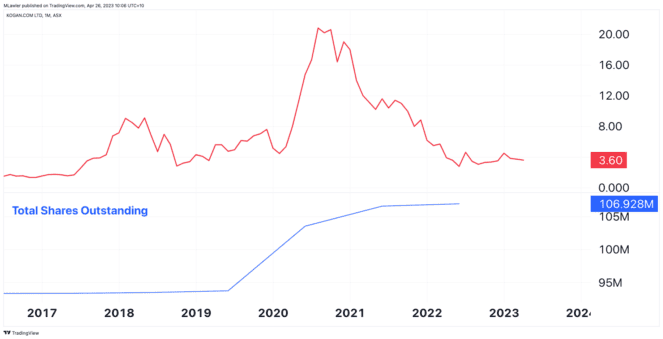

The strong financial positioning has enabled the board to initiate an on-market share buyback program. As part of the program, up to a maximum of 10% of Kogan-issued ordinary shares can be purchased by the company.

As shown above, the planned reduction in share count follows a notable expansion during the pandemic. If the full 10% allocation were used, the company's total shares outstanding would be roughly in line with pre-pandemic levels.

According to the release, the commencement of the buyback is set to be on 12 May and will come to an end on 10 May 2024.

What else is moving the Kogan share price?

In addition to the buyback news, the third-quarter update painted a reassuring picture for shareholders based on recent business performance.

Notably, inventories are now far below their abnormally high levels from a year ago. In stark contrast to the $193.9 million in the prior corresponding period, Kogan finished the quarter with $78.3 million worth of inventory on hand.

Another positive indicator noted in the release is continued growth in Kogan First subscribers, increasing 24.3% to 407,000.

On the flip side, gross sales declined 28% year on year to $188.7 million. The inflationary environment and rising interest rates were cited as reasons for the subdued market conditions.

Despite this, adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) came in at $4.4 million. Though, Kogan's statutory EBITDA remained in the negative, coming in at a $4 million loss.

The Kogan share price is still approximately 20% lower than where it was perched a year ago.