The S&P/ASX 200 Index (ASX: XJO) is now barely in the green for 2023, erasing what had been a sensational start to the year for ASX shares.

Accelerated by a barrage of concerning events within the banking industry in recent weeks, many investors are now on their toes. The collapse of Silicon Valley Bank and a takeover of Credit Suisse has called into question whether rapid rate rises are 'breaking' the system. More important is whether the fallout can be contained by the intervention of central banks around the world.

All the fear, uncertainty, and doubt are taking their toll on markets. There is a chance fear becomes the prevailing emotion if circumstances worsen, which could prompt some panic selling.

While temporarily painful, such periods of indiscriminate selling can be opportunistic for long-term shareholders.

If opportunity knocks

Two fine ASX financial shares

It appears people are shooting first and asking questions later in the financial sector, with all big four banks in the red over the past month.

If the economic situation were to deteriorate, my guess is a few ASX financial shares could be at risk of irrational selling. However, one company that I'd happily scoop up in a depressed market is Macquarie Group Ltd (ASX: MQG).

The investment bank is diversified across retail banking, asset management, commodity markets, and capital advisory. In my opinion, this makes Macquarie a much more attractive holding than the big four, as its segments smooth out the cyclicality of each individual unit.

Another ASX share I'd jump at amid any panic selling is Netwealth Group Ltd (ASX: NWL). The current valuation is hardly 'cheap', though that's my only real qualm with the company.

Considering it is taking the wealth management platform market by storm, Netwealth is an investment I would comfortably make in a falling market if the fundamentals remain unchanged.

Two quality names in health

The healthcare sector is one I particularly like due to its often defensive nature. Products and services in this industry tend to lean more toward 'needs' than 'wants' — proving resilient through all parts of the economic cycle.

Two ASX shares I'm eager to buy at lower prices are Pro Medicus Limited (ASX: PME) and Nib Holdings Limited (ASX: NHF). Both companies are intertwined with healthcare in different ways — Pro Medicus from a software angle and Nib Holdings as an insurer.

Additionally, these two businesses have a history of generating solid free cash flows. Hence, I would sleep like a baby holding these companies, even through a tumultuous period of time.

An adventurous ASX retail share

Last but not least is a retailer with an iconic and growing brand — KMD Brands Ltd (ASX: KMD).

If you're not familiar with KMD Brands, here's the long and the short of it. The company comprises outdoor clothing brand Kathmandu, surfing and sportswear retailer Rip Curl, and hiking boots brand Oboz.

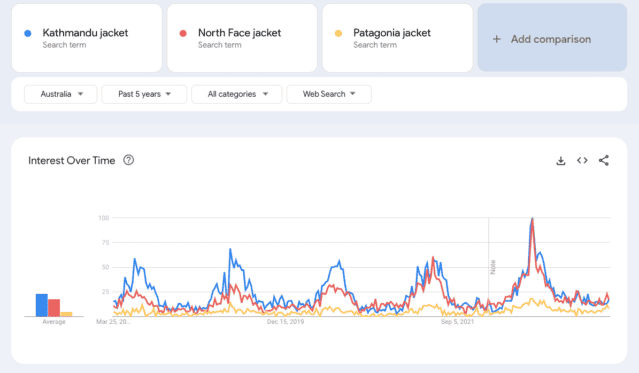

Although the outdoor clothing market is highly competitive with the likes of Patagonia and The North Face, Kathmandu goes toe-to-toe with these giants locally. As demonstrated by the search volume for jackets locally, Kathmandu is a strong contender.

The ASX retail share is now expanding to Canada and Europe, presenting an opportunity for further growth over the coming years.

Today, KMD Brands revealed it has swung back into profitability in its FY23 first-half results. An increase of 8% in sales across the United States for its Rip Curl brand is evidence of execution.