All of us at some point — barring a miraculous cure for aging — will succumb to our mortality. The following proceedings of remembrance and celebration of life will typically then be placed in the hands of a funeral operator, perhaps even the ASX All Ords share I recently invested in.

Last week, I decided it was time to bring Propel Funeral Partners Ltd (ASX: PFP) into my portfolio. The second-largest funeral operator by market share had been on my watchlist for years. During this time, I found the management team's execution of growth consistently impressive.

The combination of a solid interim result and a falling share price sealed the deal. Alas, I secured 463 shares at an average price of $4.31 — $1,995 worth of what I believe is an exceptional company.

Follow along as I explain:

- Why I'm expecting 17% per annum returns from this investment over the next five years

- An area of the business I think could be overlooked

- The line in the sand for a sell

Let's begin!

What does the industry look like?

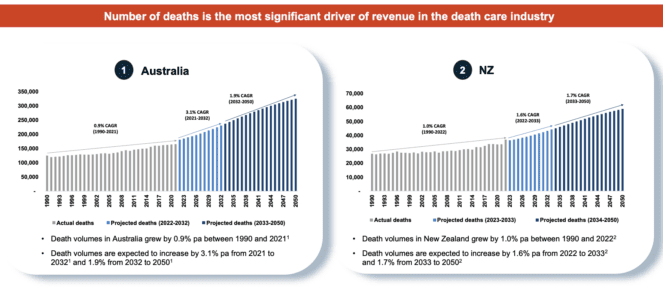

Firstly, Propel should benefit from a sector-wide tailwind for the death care services industry over the coming decades. The reality of the situation is the developed world has an aging population, leading to more deaths on an annual basis.

As noted by Propel, the next decade or so is forecast to see a compound annual growth rate (CAGR) of deaths in Australia of 3.1%. For context, this is more than three times higher than the rate of growth between 1990 and 2021.

While the increase in deaths is expected to slow between 2032 and 2050, it is still predicted to outpace our current historical rate, as shown below. If these forecasts are to be believed, most funeral operators should see an uplift in revenue.

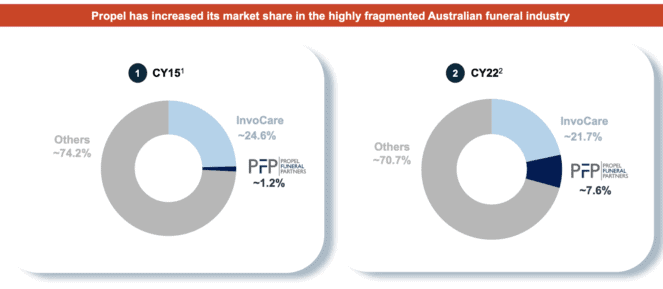

The other component of opportunity for Propel is a continuation in industry consolidation. Around 29% of the market is in the hands of InvoCare Limited (ASX: IVC) and Propel (at the end of 2022). Reducing the remaining market share — primarily made up of small independent and family-owned operators — to 71%.

I believe consolidation begets consolidation. As the two largest companies in the industry take a greater share, small operators could come under greater pressure, increasing the likelihood of further mergers and acquisitions at attractive prices.

Clear growth strategy ahead

Propel holds a commendable track record for bolting on additional brands and operations. Since 2013, the company has expanded from one location in Queensland to 152 across most of Australia and New Zealand.

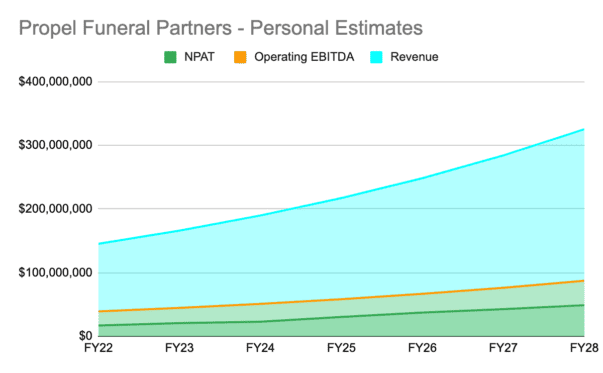

If the company continues to grow its market share, my conservative estimate is that revenue will grow at an annual compounded rate of around 14% out to FY28.

Realistically, I think Propel could end up exceeding this estimate. The company's much larger rival, InvoCare, managed to grow its revenue by around 12% in both FY21 and FY22. Starting from a small base, Propel should find it easier to grow at a faster pace given the law of large numbers.

My own projections have this ASX All Ords share pulling in net profits after tax (NPAT) of $48.8 million in FY28. At that time, the business will be in a much more mature position, so I've assumed a price-to-earnings (P/E) ratio of 20 times.

These estimates add up to a projected market capitalisation of $914.5 million — 79.5% above today's valuation.

What could be getting overlooked?

There's another income source for Propel that I haven't factored into my forward projections, that could deliver high-margin income… investment income from prepaid funerals.

It's a somewhat controversial practice. Funeral providers offer people the option to pay for their funeral in advance, allowing the company to earn returns on the funds until they are required. As long as the funds are grown beyond the cost of the agreed-upon service, the difference can be pocketed.

Overall, the additional returns from this are likely to be modest. At the moment, Propel's contract assets are actually $4.8 million in the red compared to its liabilities. However, it is worth at least knowing that this business practice could influence the bottom line later on.

What would prompt a change of mind?

Even the best companies can fail to deliver. That's why it is helpful to lay out the conditions for failure in advance. For this, there are two key aspects of the business I'll be keeping close tabs on:

- EBITDA margins

- Merger and acquisition activity

Firstly, EBITDA margins will be valuable for monitoring any detriment to profitability if cremations grow in popularity.

The alternative to burials is a cheaper option, which could present a headwind. Propel's most recent full-year margin came in at ~27%. Personally, I'd have some concerns if this metric were to fall below 20%.

Secondly, my thesis for this ASX All Ords share rests on management sustaining its approach to industry consolidation, increasing its market share. I personally don't believe the company will grow to its valuation 100% organically. As such, if a halt to its acquisition activity occurred for some reason, I would reconsider my investment.

Final takeaway

There are few things in life as predictable as death. As an investor, I look at a company like Propel and see a business that provides an essential service. A service that possibly will never be disrupted.

The older I get, the more value I see in businesses that could exist for 30 years, 50 years — heck, even 100 years. Indeed, the best investment I could make is one that outlives me… how ironic.

Like other great long-term compounders on the ASX such as Washington H. Soul Pattinson and Co Ltd (ASX: SOL) and Brickworks Limited (ASX: BKW), Propel may not be the most exciting ASX All Ords share, but I think it could have the staying power needed to allow compounding to work its magic.