If you have purchased a lottery ticket online in Australia, there's a fair chance you've used a platform provided by Jumbo Interactive Ltd (ASX: JIN). This ASX All Ords share has cut out a respectable slice of a growing market and raked in considerable profits in the process. Yet, the Jumbo Interactive share price is down 21% in the past year.

I pulled the trigger on adding more Jumbo shares to my portfolio amid the depressed valuation during the second half of 2022.

Here is why I see further upside to this investment over the coming five or so years, potentially making it a cheap ASX share. In addition, I provide my current concerns for the company and what would prompt me to unwind my position.

Compelling solution spreading its wings

Whether it is your bet on the horses, food delivery order, or stab at being a millionaire — everything is shifting online.

The digitisation drivers are simple for the lottery industry… consumers want to purchase a ticket from the comfort of their couch, rather than lining up in a store. Meanwhile, lottery retailers want to make bigger profits through a more scalable approach.

For decades, Jumbo Interactive has catered to these combined demands through its fully compliant lottery software. Along the way, agreements were entered to resell Tabcorp, now The Lottery Corporation (ASX: TLC), on Jumbo's Ozlotteries website, propelling further growth for the ASX All Ords share.

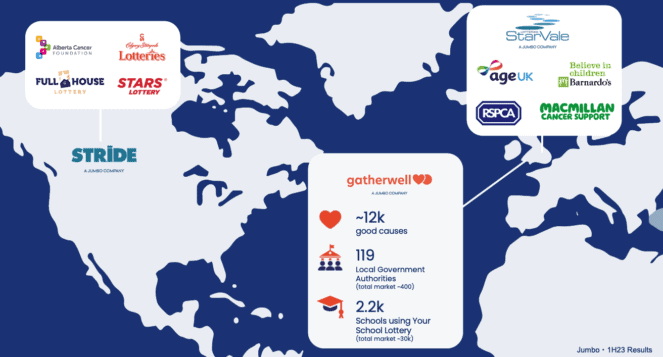

Over the past five years, Jumbo has achieved profit margins exceeding 20%. Impressively, this was done without any leverage on the balance sheet up until recently. However, the move to expand into the United Kingdom and Canada (pictured below) is a necessary one, in my opinion, to deliver further growth for shareholders.

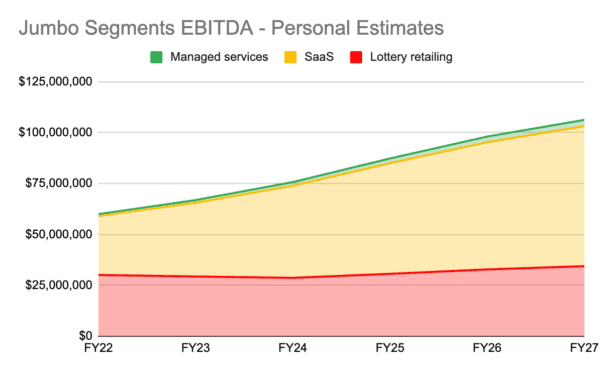

I'd argue, the main upside in this ASX share is contained in providing its software (Powered by Jumbo) to government and charity lottery operators. Currently, software as a service (SaaS) has the best EBITDA margins of the company's three segments, at ~68%.

Governments and charities are less likely to deploy the resources to develop their own online solutions. As opposed to the likes of large private lottery operators, such as The Lottery Corporation, which Jumbo is now engaged in a precarious dance with — more on that later…

Furthermore, as discovered by Regulus Partners in their Charity Lotteries and the European Lottery Sector: impact analysis report, charity lotteries typically outperform state lotteries on a revenue growth basis. Sounds like an attractive part of the market for Jumbo to go after, right?

Between a rock and a hard place

Now, more on that precarious dance I alluded to earlier… While I do believe Jumbo shares have been cheap, it is not without some reason.

The company could be coming to a crossroads where it needs to break free from the very thing that boosted it to success in the first place — lottery retailing for Australia's largest lottery company. I suspect the increased Lottery Corp service fee under the agreement renewal in 2020 has been a major catalyst for Jumbo's invigorated acquisition strategy.

Under the agreement, Jumbo will pay the larger ASX share a max fee of 4.65% of the ticket price from FY24 onwards, which has been incrementally increasing from 1.5% since FY21. Unfortunately, the lottery retailing segment is Jumbo's largest revenue source.

Ultimately, Lottery Corp knows that Jumbo needs it, but it doesn't need Jumbo, as it operates its own digital sales channel through TheLott. Hence, there is a real risk of more service fee increases in the future, which would be painful for the bottom line.

In the first half of FY23, EBITDA margins for the segment shrunk by 3.3% to 30.6% — partly attributed to the 1% fee rise.

As shown above, I believe lottery retailing earnings (red) will struggle to grow significantly over the next five years despite my belief that total transaction value (TTV) growth will remain between 5% to 10%. However, I'm expecting Jumbo's SaaS operations (yellow) to deliver if the company can capitalise on its entry into new markets.

When would I reconsider holding this ASX share?

Fortunately, The Lottery Corporation is locked in with Jumbo until 2030, barring any contract breaches. In my eyes, that gives the ASX All Ords share around another seven years to de-risk its earnings profile and establish other avenues for growth.

If Jumbo fails to grow its SaaS business meaningfully, i.e. around 20% to 25% segment TTV growth in FY23 and FY24, then I'd seriously have to question the company's future earnings potential.

Secondly, Lottery Corp offers online charity lotteries through a partnership with the 50-50 Foundation under the Play For Purpose banner. The online solution is operational with more than 500 charitable causes.

In my opinion, it would be a major red flag if any of Jumbo's current charities decided to switch to this alternative option.

Final takeaway

Investors don't like uncertainty. Where the relationship between Jumbo and The Lottery Corp goes from 2030 onwards is unknown, adding pressure on the price of this ASX share. But, there is a seven-year window between now and then, and a lot can be accomplished during that time.

Seven years ago, Jumbo Interactive reported a first-half profit of $1.9 million. Last week, the company reported a first-half profit of $17.2 million — a ninefold increase.

My conviction lies in a well-incentivised management team and a structural shift to digital. For those reasons, I believe Jumbo shares could still be a reasonably cheap buy at current prices.