It has been a hellacious year for investors seeking inflation-beating returns. Those with exposure to certain commodities have generally performed stronger than other pockets of the market. Yet, 2022 probably won't go down as a triumphant one for copper.

Unlike lithium, the price of copper has descended throughout the year rather than strengthen. In quantifiable terms, lithium has skyrocketed by more than 100%. Meanwhile, a chunk of copper is going for 15% less. The stark contrast has played out despite both materials being expected to benefit from the electrification trend.

Although, the script might be flipped next year, according to some experts.

Supply won't cope with demand

All commodity prices are determined by the balance of supply and demand. That's why Goldman Sachs is expecting big things from the highly conductive metal in 2023.

The broker believes copper could reach a new record high price of US$11,000 per tonne. Its bullish forecast doesn't come without reason. Goldman is estimating a 178,000-tonne copper deficit next year. Whereas, the broker previously forecast a 169,000-tonne surplus, betting on new supply coming online.

However, forecasts are suggesting that additional supply may not materialise. Any such slump in supply could boost prices if demand for the material holds steady or increases — a scenario that copper investors would be glad to witness in light of the poor performance in 2022 as shown below.

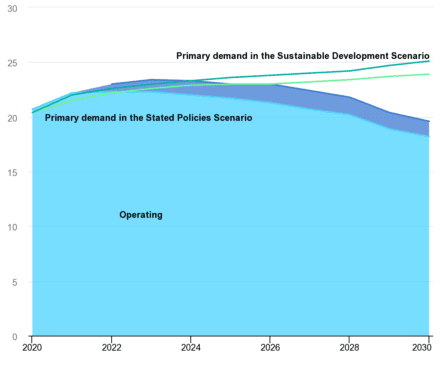

Data presented by the International Energy Agency (IEA) similarly portrays a roadmap for increased copper demand in the future. In a report titled The Role of Critical Minerals in Clean Energy Transitions, the IEA estimate that 45% of copper will be consumed by the energy sector in 2040 under its 'sustainable development scenario'.

Under these conditions, current (operating) and future (under construction) supply will fall short of demand by 2025. As depicted in the chart below, this gap is only expected to widen for the foreseeable future.

Biggest ASX copper shares in the hot seat

If copper enjoys a rise that is anything like lithium this year, the returns from ASX copper shares could be considerable. After all, some of the best-performing investments on the Aussie market this year have been in lithium shares.

At the largest end of the market, here's how the biggest lithium names have performed in 2022:

- Rio Tinto Limited (ASX: RIO) up 18%

- Mineral Resources Ltd (ASX: MIN) up 65%

- Pilbara Minerals Ltd (ASX: PLS) up 47%

- Allkem Ltd (ASX: AKE) up 36%

For those interested, some of the largest ASX-listed companies with exposure to copper include BHP Group Ltd (ASX: BHP), Rio Tinto Limited (ASX: RIO), Newcrest Mining Ltd (ASX: NCM), and IGO Ltd (ASX: IGO).