This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Shares of Nvidia (NASDAQ: NVDA) continue to get clobbered. As of this writing, the stock is now down more than 40% from all-time highs reached in late 2021. Several worries are conspiring to bring down Nvidia, the semiconductor industry, and tech in general right now.

These include the Federal Reserve's aggressive rate hike posturing, calls for a slowdown in consumer spending, and a possible reduction in demand for graphics processing units (GPUs) needed in cryptocurrency mining.

Nvidia faced challenges like this just a few years ago. It overcame those issues then, but what about now?

Nvidia is a cyclical stock

All businesses are cyclical for one reason or another -- meaning business ebbs and flows based on supply and demand and other economic factors. For Nvidia and chip stocks in general, the cyclicality tends to come from the pacing of hardware purchases. Every few years, consumer and business demand for computing hardware slows, and chip stocks fall. Later, as signs emerge that hardware purchasing might pick up pace again, chip stocks rally.

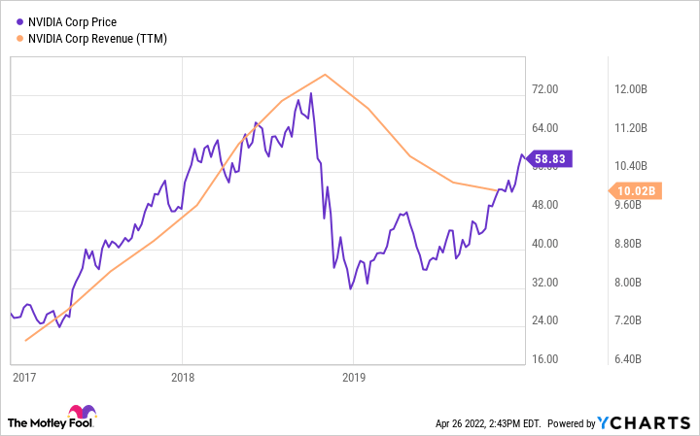

This is what happened to Nvidia in 2018. GPU sales fell (the crypto market crashed, the US-China trade war pressured demand for chips, the Fed was raising interest rates, too), and Nvidia's stock tanked. But then it went on an epic tear starting in 2019 as a new generation of chips for video gaming, data centers, and artificial intelligence (AI) came out.

Data by YCharts.

Is the current environment a simple repeat of history? Probably not. Nvidia is a different company than it was four years ago. It's more diversified now with other chips outside of its GPU bread-and-butter product. And though some of the themes dragging down the chip industry rhyme with the 2018 situation, the economy is also facing very different issues today.

If chip sale growth stumbles at some point later this year or next (Nvidia forecast 43% year-over-year revenue growth for the fiscal first quarter, which will be reported on May 25, there's no guarantee it will return to the torrid pace of expansion it has enjoyed during the pandemic.

Plus, even after falling 40% in recent months, shares still trade for 60 times trailing 12-month free cash flow and 28 times one-year forward expected earnings. This is no cheap stock.

The case for Nvidia as a $1 trillion company

In spite of mounting worry of an economic slowdown and the fact Nvidia is already a giant among tech stocks, Nvidia's diversification today could actually be a benefit in the next few years. More than a designer of semiconductors like many of its peers, this is a full-blown tech platform. Nvidia is designing hardware and software, that puts the power of AI into the hands of all industries -- from healthcare to the automotive industry, and even other tech companies.

These are powerful secular growth trends that could help propel Nvidia higher for many years to come. For what it's worth, some analysts think Nvidia's revenue will more than double to over $65 billion in five years (compared to $26.9 billion in revenue during the recently-completed fiscal year ended in January 2022). If Nvidia delivers on those lofty expectations, a $1 trillion valuation doesn't seem out of the question (the company's enterprise value sits at $489 billion as of this writing).

Of course, if you're the type of investor who wants to see a company "prove it" and only buys when a stock is a reasonable value, take a pass on Nvidia right now. But if you believe this tech giant will continue to sink its roots into the global economy with its AI platform in the years ahead, you don't mind extreme bouts of volatility, and can make periodic purchases to add to your position (dollar-cost averaging), now looks like a great time to go shopping for some Nvidia shares.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.