Image source: Getty Images

Introducing discounted cash flow

Discounted cash flow (DCF) is a valuation methodology used to determine the current value of investments. It's based on the theory that an investment's current value should equal the present value of its future cash flows.

Investors expect investments such as bonds or shares to generate future cash flows through interest or dividend payments.

According to the DCF valuation method, the present value of an investment should be the sum of all future cash flows from that investment, discounted to take account of the time value of money.

What is the time value of money?

The time value of money is a core financial principle that means a dollar received today is worth more than a dollar received next week or next year. This is because a dollar received today can be invested and earn returns so that it's worth more in the future.

In other words, the money you expect to receive in the future is worth less than if you received it today because you are forgoing the returns you could earn by investing it now.

Analysts and investors can determine the present value of a sum of money to be received in the future by discounting it appropriately.

Discounted cash flow accounts for the time value of money by discounting future cash flows to determine their present value. Theoretically, by summing up the present value of all future cash flows from an investment, we can determine its current value.

To do so accurately, however, we need to estimate the future cash flows correctly and use an appropriate discount rate. The higher the discount rate used, the lower the present value of a sum of money will be.

For example, if we expect to receive $1,000 in one year, its present value will be $952.38 if we use a 5% discount rate. If we use a 10% discount rate, the present value will be $909.09.

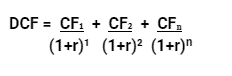

What's the DCF formula?

CF = the cash flow for a given year: that is, CF₁ is the cash flow for year 1, CF₂ is the cash flow for year 2, and CFₙ is the cash flow for future years.

r = the discount rate.

Because we calculate the DCF model using projected future cash flows, the accuracy of these projections is key to ensuring the model's accuracy. Using the correct discount rate is also crucial to ensure the accuracy of outputs from the DCF model.

The discount rate used in the DCF model will depend on an investor's minimum rate of return. For example, say we offered to pay you $1,000 in one year. If the minimum rate of return you require is 5%, then you should be willing to pay us up to $952.38 now (assuming there is zero risk of us defaulting). On the other hand, if your minimum rate of return is 10%, you would only be willing to pay us up to $909.09 now.

If there is a risk we will default, you will need to adjust the discount rate accordingly. As such, there is no right or wrong rate of discount. The rate will differ between investors and will also be based on the attributes of the investment and capital market conditions.

Companies often use their weighted average cost of capital as the discount rate when using the DCF model to assess an investment. This is because the weighted average cost of capital accounts for returns expected by its shareholders and bondholders.

When would you use a discounted cash flow model?

We can apply the DCF model to any investment where you pay money now and expect to receive money in the future. Accurate inputs into the DCF model can indicate whether a potential investment is overvalued or undervalued.

If the DCF model gives a result higher than the current price of the investment, this indicates the investment is undervalued and potentially worthy of consideration. If the DCF model provides a result lower than the current price of the investment, it suggests the investment may be overvalued, so you might want to look elsewhere.

Let's look at an example. Say you have the opportunity to invest $1 million today, with that investment expected to generate cash flows of $250,000 per year over the next five years. The table below shows the value of the discounted value of these cash flows, assuming a discount rate of 5%:

| Year | Cash flow | Discounted cash flow |

| 1 | $250,000 | $238,095 |

| 2 | $250,000 | $226,757 |

| 3 | $250,000 | $215,959 |

| 4 | $250,000 | $205,675 |

| 5 | $250,000 | $195,881 |

If you sum up the discounted cash flows, you get $1,082,369. This is more than $1 million, indicating you should consider the investment opportunity.

How would you use the model?

The DCF model attempts to measure the value of an investment directly, as its value is ultimately derived from the inherent value of the cash that flows to investors. The DCF model is commonly used to evaluate a company's value and compare businesses.

To evaluate a company's value, analysts will project its cash flows over a certain period and a terminal value for the business at the end. These monetary values are then discounted appropriately and summed up to determine the company's present value. We can calculate the valuation of each business using the DCF model to compare businesses.

What are the limitations of the discounted cash flow model?

There are several limitations to the DCF model. The valuation provided by the model is sensitive to the assumptions and forecasts used in generating it. Changes in these assumptions and projections can lead to significant differences in the results of a DCF valuation.

Because the DCF model requires predicting future events, actual outcomes may differ from those anticipated. Even the best forecasters cannot predict the future with 100% accuracy, so the results of the DCF model may prove different from reality.

The DCF model also does not consider market-related information, such as the value of comparable companies. Using this information can provide a sanity check on the results of the DCF model, so it is recommended that DCF analysis be employed in conjunction with other valuation techniques. This can help ensure that inaccurate assumptions or forecasts do not result in a significantly different valuation from that indicated by market forces.

Although theoretically sound, the DCF model is sensitive to the assumptions and forecasts it relies on. You may have heard the phrase 'garbage in, garbage out' – this means that if your assumptions are faulty, you could end up with a nonsense answer.

Forecasting future performance is notoriously tricky, which is one of the drawbacks of using DCF. On the plus side, DCF is not influenced by temporary market conditions or non-economic factors. It can also be helpful when there is limited information to compare a potential investment.

Frequently Asked Questions

-

Discounted cash flow (DCF) is a valuation methodology that assumes an asset's current value should equal the 'present value' of its future cash flows. In much the same way as you can work out how much you'll have in your bank account in a year's time by multiplying it by your annual interest rate, you can also work backwards to determine an appropriate present value of a cash flow to be received in a year's time. In finance, this is referred to as 'discounting'.

Net present value (NPV) is very similar to DCF, but it takes the analysis one step further. While DCF focuses exclusively on future cash flows, an NPV analysis includes upfront costs. When businesses are using discounted cash flow analysis to determine which projects to pursue, they might rather use NPV as it takes into account the capital expenditures they need to make to initiate the project (for example, buying new machinery or equipment).

-

There is no right or wrong discount rate to use. In fact, it will often come down to your own personal return requirements and your view of the riskiness of the investment.

For example, you might desire a high rate of return from your investments, which will mean your discount rate will be quite high. However, it's also important to be realistic about your desired return. The higher the discount rate you use, the lower your derived present value and the more likely potential investments will appear overvalued based on current market prices, leaving you with fewer options.

You should also adjust your chosen discount rate to reflect the perceived riskiness of a potential investment. If it's likely that future cash flows might not eventuate (for example, if the company you're investing in is at risk of default), you should require a higher return to compensate you for the additional risk.

-

The DCF model can be used to assess any investment where you pay money now expecting to receive money in the future. This could be an interest-earning deposit, a bond where you receive regular coupon payments or a stock that pays regular dividends. Companies also often use DCF analysis to decide which projects they should invest in based on their expectations of the project's future cash flows.

If the DCF model gives a result higher than the current price of the investment, this indicates the investment is undervalued and potentially worthy of consideration. If the DCF model gives a result lower than the current price of the investment, it indicates the investment may be overvalued, so you may want to look elsewhere.