The basket of S&P/ASX 200 Index (ASX: XJO) gold shares has slipped into the red during today's session.

And looking beyond the ASX 200, to the 27 ASX-listed gold shares with a market capitalisation of over $200 million, the average loss today is 1.47% and the median loss is 1.5% (at the time of writing).

What's impacting ASX 200 gold shares today?

Firstly, the spot price of gold is down around 5% over the past month and a similar amount over the past six months, extending the loss over the past year to approximately 15%.

Moreover, the spot price of gold took a 3–4.5% dip over the past two days, with the yellow metal now trading at $1,736 per ounce.

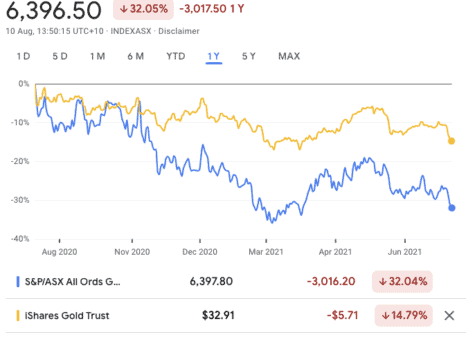

There is a high correlation between the price of gold and ASX 200 gold shares, as can be gleaned from the chart below. That is, the pair tend to move in a relatively similar fashion. The chart highlights the single year performance of the S&P/ASX All Ordinaries Gold Index (ASX: XGD) versus the iShares Gold Trust.

For context, according to the issuer iShares, its Gold Trust "seeks to reflect generally the performance of the price of gold" whereas the All Ords' Gold index "is a benchmark for Australian gold companies". Therefore, both are acceptable proxies for our analysis.

Correlation between ASX Gold shares and price of gold, last 12 months

Source: Google Finance

Notice the synchronised movement (movement, not actual price) in the pair's price returns over the last year, for instance.

Adding weight to this correlation is the underperformance of key ASX gold shares today.

To illustrate, Newcrest Mining Ltd (ASX: NCM), Evolution Mining Ltd (ASX: EVN), Northern Star Resources Ltd (ASX: NST) and St Barbara Ltd (ASX: SBM) shares have all slipped into the red today, amid many other well-known names.

For comparison, the S&P/ASX 200 Index has climbed about 0.2% into the green during today's session.

Therefore, given the correlation between gold spot and ASX gold shares, it stands to reason that this recent volatility will have some bearing on the ASX gold basket's price action today.

What about inflation?

Inflation is certainly a contentious issue in the global economy at the moment, with commentary from both sides around the globe weighing in on the debate.

For instance, discussions on "inflation" were at a record high among S&P 500 company earnings calls this quarter, increasing 900% year on year, according to Bank of America.

Gold has traditionally been viewed as a reasonable hedge against inflation. However, data shows the correlation of gold to inflation has been historically low over the past 50 years, at only 16%. A correlation of 50–100% is considered statistically significant.

Next, central banks use their position in the marketplace to regulate factors such as inflation and interest rates.

In fact, one of the Reserve Bank of Australia (RBA)'s primary functions is to maintain inflation within a range of 2–3%.

In order to achieve this, the RBA utilises its position in the money markets to indirectly increase interest rates, which flows on to contain the fire of inflation in the real economy.

What about interest rates and ASX gold shares?

A hike to interest rates is generally seen as a headwind to gold prices as investors seek yield in higher rewarding asset classes, such as fixed income.

The RBA's posture has been to hold rates down since 2020, even throughout the COVID-19 pandemic. For instance, the RBA has stated the cash rate will remain flat at 0.1% until 2024 at the current trajectory.

However, the Commonwealth Bank of Australia (ASX: CBA), amongst other banks, predicts this rise will occur sooner. CBA just adjusted its 2-year and 4-year mortgage rates to reflect its viewpoint, the third increase this year.

Given the bank's move, it is not unreasonable to expect other financial institutions to follow suit, thereby acting on their conviction.

Therefore, it stands to reason that the recent selloff in ASX gold shares is somewhat impacted by the uncertainties on interest rates in the economy.

Foolish takeaway

ASX Gold shares have had a rough day on the back of headwinds in the underlying gold markets and in the real economy.

Gold prices are sensitive to market forces such as interest rates and often there is a conception that gold, on its own, is a reasonable hedge against inflation. There is debate on whether it is or not.

As the uncertainties on interest rates continue in Australia, this may have some bearing on ASX gold shares as we walk through the remainder of 2021.