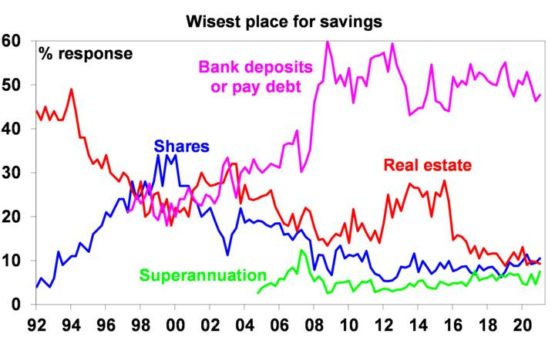

More Australians favour shares over real estate as a way to invest, in a rare result for our usually property-obsessed country.

Every quarter, Westpac Banking Corp (ASX: WBC) and the Melbourne Institute's survey asks "Where is the wisest place for your savings?".

In the latest numbers released this month, the real estate vs shares tussle was turned on its head.

"In March, just 9.3% of consumers nominated 'real estate', the third-lowest result in the 47 years we have been running the question," said Westpac chief economist Bill Evans.

"More consumers (10.5%) favour shares than real estate."

The property market, especially residential, has been rising incredibly the past 6 months due to near-zero interest rates.

But perhaps the loss in confidence in real estate indicates that Australians don't think those exorbitant prices are sustainable.

"Markets and some commentators have been warning against damaging housing bubbles. The survey points to rising house prices although investors still appear cautious," said Evans.

"Owner occupiers, including first home buyers, may already be becoming deterred by the associated deterioration in affordability."

There's still plenty more money to come into share markets

Perhaps more stunningly, a combined 48% of Australians thought it was better to park their money into their bank account or paying down debt than investing it in shares.

There are worries that shares are overvalued after more than 435,000 Australians bought their first stock last year with their lockdown savings.

But the finding that half the country still thinks putting their money in the bank is a better bet shows there's still enormous potential for additional capital to flow into the ASX.

During the dot-com bubble in the late 1990s and early 2000s, more than 30% of Australians thought the share market was where their money should be.

"Interestingly, while consumers are feeling confident, they are still cautious when it comes to investing, with the proportion seeing shares, super and even real estate as the 'wisest place for saving' remaining relatively low," said AMP Ltd (ASX: AMP) economist Shane Oliver.

"This is still positive though for shares and real estate from a contrarian perspective."

This outlook is why Oliver advised stock investors to hold firm through the current volatility.

"Looking through the inevitable short-term noise, the combination of improving global growth helped by more stimulus, vaccines and still low interest rates augurs well for growth assets generally in 2021," he said.

"Expect the S&P/ASX 200 Index (ASX: XJO) to end 2021 at a record high of around 7200."

The current record for the ASX 200 index is 7199.79, set in February 2020, just before the market crashed out of COVID-19 recession fears.