One-fifth of Australian share investors would own shares that went against their personal beliefs if it meant reaping a higher return.

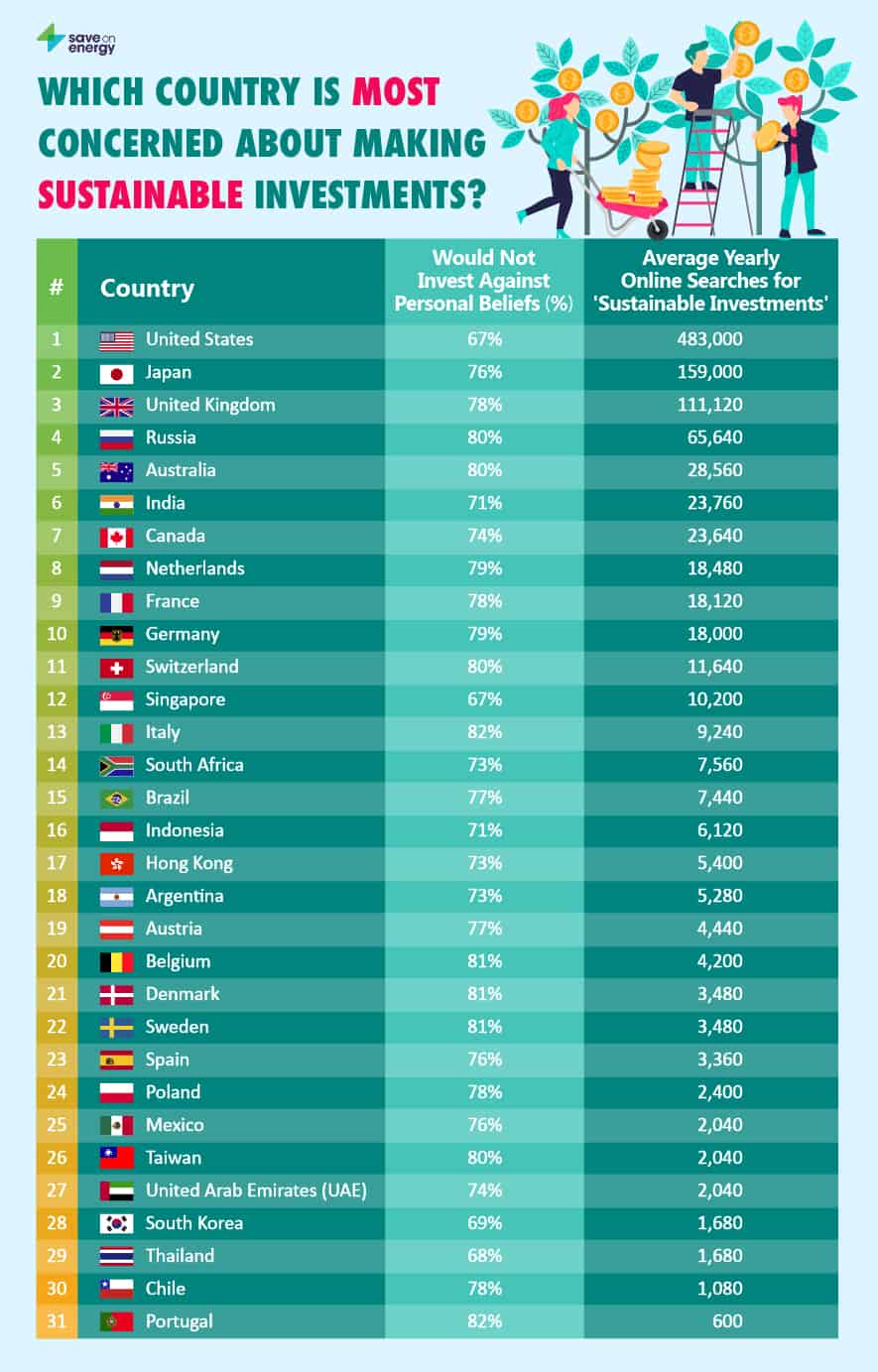

The finding came out of an international study conducted by UK company SaveOnEnergy, which showed US and Japanese investors were the most concerned about holding sustainable investments.

The data, sourced from investment firm Schroders (LON: SDR), showed Australians were ranked 5th.

Although 80% of Australian investors would never buy into a company that went against their moral code, 20% were willing to go for it in the search for higher returns.

The environmental issue that the most Australian investors thought companies should be focusing on this year was global warming.

Environmental priorities for Australian investors

| Rank | Issue | % of Australian investors |

|---|---|---|

| 1 | Global warming (climate change) | 59% |

| 2 | Plastic pollution | 55% |

| 3 | Air pollution | 52% |

| 4 | Biodiversity loss | 47% |

| 5 | Food waste | 44% |

| 6 | Deforestation | 40% |

| 7 | Water pollution | 36% |

| Source: SaveOnEnergy; Table created by author | ||

Plastic pollution and air pollution were not far behind, with 55% and 52% respectively judging it as a high priority in 2021.

Almost 2-in-3 Australian investors thought companies can do "much more" this year to improve environmental sustainability.

World is moving on to a new era

Despite the significant number willing to sacrifice the environment for higher returns, the world seems to be moving on with finances and sustainability increasingly linked to each other.

The rise-and-rise of Tesla Inc (NASDAQ: TSLA) shares is a case in point.

Investors savvy enough to bet that zero-emission electric cars are the way of the future saw their stocks rise almost 700% during 2020. Tesla shares have soared another 4% on top of that in the first few days of this year.

A more local example is AGL Energy Limited (ASX: AGL)'s Liddell power plant.

Last month investor groups called for the coal-powered station to be shut down.

An AGL employee suffered a serious injury after an incident at one of Liddell's power generation units, causing it to be temporarily closed. The unit could be inactive for 2.5 months, skipping over the entire high-demand summer season.

Australasian Centre for Corporate Responsibility director Dan Gocher said at the time maintenance costs for ageing coal plants increased from 25% of AGL's total capital spend in 2013 to 74% in the 2020 financial year.

"Investors must question whether this expenditure is in the long-term interests of shareholders," he said.

"AGL intends to operate Bayswater beyond 50 years, and Loy Yang A beyond 64 years. It's ridiculous and completely out of step with Australia's climate goals and it will continue to risk the safety of its workers."