Washington H. Soul Pattinson & Co Ltd (ASX: SOL) has once again proven why it's the king of the ASX dividend shares.

The industrial conglomerate was a latecomer to earnings season, only reporting its full-year earnings for the 2020 financial year this morning. The markets initially liked what they saw, given that the Soul Patts share price spiked as high as $23.99 earlier this morning.

And fair enough too. See, Soul Patts announced something very special today, something that makes this ASX dividend share pretty unique. It wasn't the statutory profit after tax of $953 million though (up 284.3% year on year). Or the near 50% increase in cash flows from investments to $252.3 million.

No, it was the dividend announcement.

An ASX dividend aristocrat

On the surface, Soul Patts' final dividend of 35 cents per share, fully franked and set to be paid on 14 December, doesn't look that special. After all, it brings the company's dividends to 60 cents per share for 2020 (a 2.4% rise over 2019), which, on current prices, equates to a yield of 2.57% (or 3.67% grossed-up with franking).

2.57% is nothing to sneeze at of course, especially in our environment of record-low interest rates. But it's not as numerically appealing as some other ASX dividend shares out there.

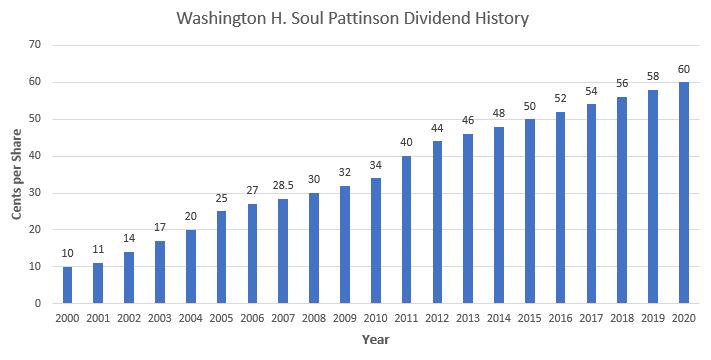

But what does make this dividend unique is its history. Soul Patts, with this announcement, becomes the only ASX dividend share in the All Ordinaries Index (ASX: XAO) to boast a history of increasing its dividend every year since the year 2000. That's 20 years of uninterrupted dividend hikes. Just take a look at this beautiful graph below for a visual illustration.

Now that's what you want to see in an ASX dividend share — dividends growing from 11 cents per share in 2000 to 60 cents per share in 2020. That's an average compounded annual growth rate (CAGR) of 9.2% per annum. That 9.2% makes a difference over time too! Anyone who bought Soul Patts' shares exactly 20 years ago for $3.55 per share would be looking at a yield on-cost of 16.9% per annum today. That's the power of a good dividend growth share.

Is the Soul Patts share price a buy today?

I think the Soul Patts share price is definitely a buy for any long-term dividend investor today. That kind of dividend royalty makes this company very special in my view. Its varied portfolio of ASX shares and unlisted assets make this company a balanced and diversified investment. Through this company, you are also owning quality shares like TPG Telecom Ltd (ASX: TPG), New Hope Corporation Limited (ASX: NHC) and Brickworks Limited (ASX: BKW). Soul Patts won't make you rich overnight (like all good investments), but can offer the kind of slow-and-steady growth that can really compound over time. As such, I think it is a must-own for any ASX dividend investor today.