The spot gold price surged to its highest level since 2011 on Friday, and a new tailwind is likely to lift it above its all-time record high.

The precious metal jumped another 0.8% at the end of the week to US$1,902 an ounce and is now less than US$20 away from its peak of US$1,921 per ounce, which was set nine years ago.

While many of the factors supporting the surging gold price have been well documented, the tailwind that has driven the gold price above the psychologically important US$1,900 level isn't so obvious.

Gold finds a new friend

This is the weakening greenback with the US Dollar Index (a measure of the US dollar against a basket of other major currencies) slumping to a two-year low.

The US Dollar Index slipped 0.4% on Friday to 94.35 and has fallen over 8% since the height of the COVID-19 market meltdown in March.

The other big drivers of the gold price are well documented. Record low interest rates and money printing by central banks, including Australia and the US, have created a favourable backdrop for the commodity, before the exchange rate gave it the extra push to retake US$1,900.

Tailwinds to persist

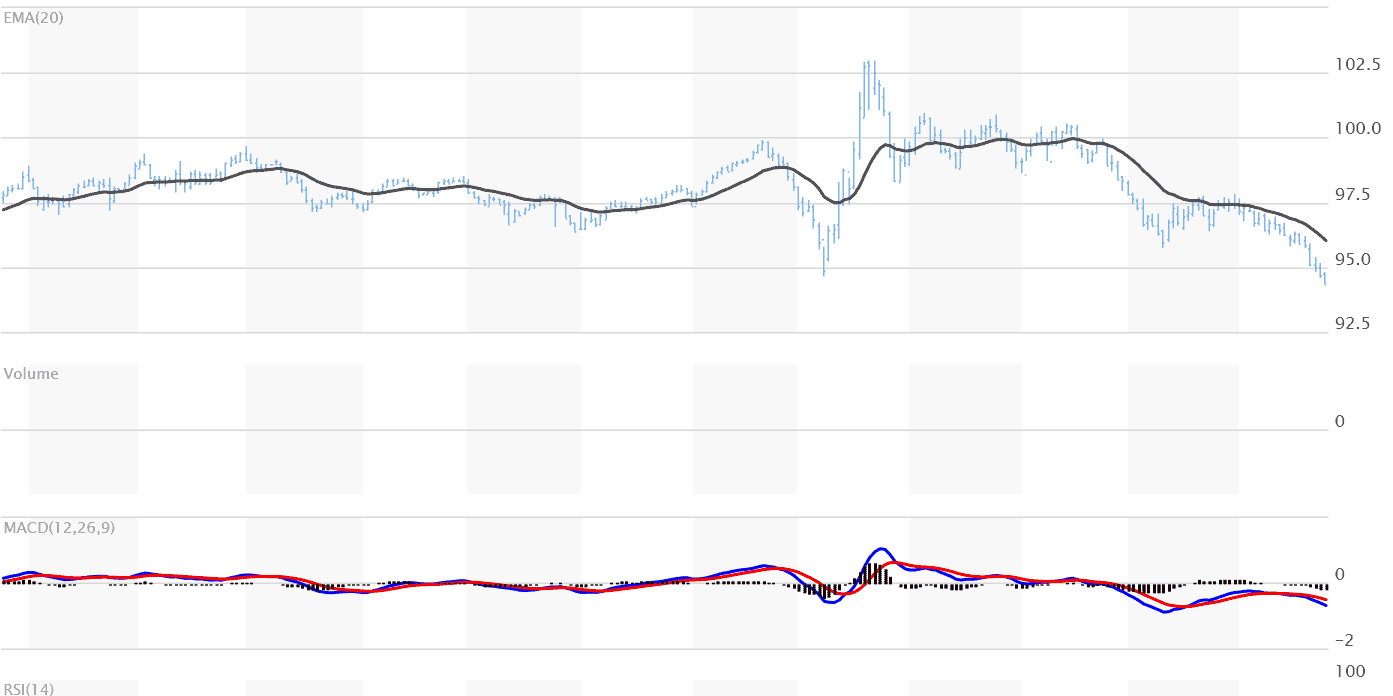

What's more, the US dollar tailwind isn't abating. You don't need to be a technical analyst to see that the chart is indicating the path of least resistance is down for the almighty dollar – at least in the near-term.

US Dollar Index (DXY) – 1 Year

Source: Market Watch

The inability of the US to control the rate of COVID-19 infections and deaths is behind the bout of US dollar weakness. No one believes this situation is about to change anytime soon and this means its currency will remain under pressure.

Lack of safe havens to fuel gold's bull run

The US dollar is the world's reserve currency and a safe haven for nervous investors. But when the problems in the US are this deep, investors aren't willing to shelter under the dollar.

This has implications for the other globally recognised "risk-free" asset – US government bonds. While the value of these bonds will likely hold up well in any crisis, investors could still be nursing a loss on the currency unless they hedge this risk. This adds an additional layer of cost and complexity.

A similar theme is emerging for the Japanese yen with the risk of a second wave outbreak emerging in the country.

Gold price likely to keep running through 2021

Gold is standing tall as the world runs out of safe haven assets, and I don't believe this trend will turn until the US dollar regains its risk-free status. This probably won't be until sometime in 2021 or 2022.

What this means is that gold is likely to breach the US$2,000 level – something that I forecasted in April. If it does, it may very well stay above that bullish level for much of the next 12 to 24 months.

ASX gold miners on consensus upgrade cycle

As most analysts aren't forecasting the yellow metal to break and hold above its 2011 record high, this could prompt them to upgrade their earnings forecasts and valuation for ASX gold miners.

This could see the share prices of major producers like Newcrest Mining Limited (ASX: NCM), Evolution Mining Ltd (ASX: EVN) and Northern Star Resources Ltd (ASX: NST) rise further in FY21.

One thing to note, however, is that investors may now favour ASX gold stocks with mines located overseas, instead of those with local operations.

When gold was rising before the COVID-19 outbreak, it was doing so while the Australian dollar was falling. This gave local gold mines an extra boost as their cost base is denominated in the weakening Aussie. The opposite is now happening in the second phase of the gold price rally.