There are many different approaches employed by investors attempting to generate solid returns from the ASX. However, for your average investor, I believe by far the best is to take a long-term investing approach.

A long-term investing strategy has a number of benefits. For instance, trading costs will be considerably lower and, as I will demonstrate, this can have a significant impact on portfolio returns. Especially as compounding takes hold. Additionally, holding shares for longer than 12 months means you are eligible for a capital gains tax (CGT) discount. So, instead of paying your marginal tax rate on 100% of your capital gains, if you hold the shares for more than 12 months, you'll only pay tax on 50% of the gain.

Lastly, the CGT is paid upon each sale of a company. This means the amount you can reinvest is lower due to the tax that has been paid, which hurts your portfolio's compounding ability.

These few advantages may not appear to be overly significant, however let's look at a couple of scenarios to show just how much of a difference long-term investing can make.

Long-term investing versus short-term investing

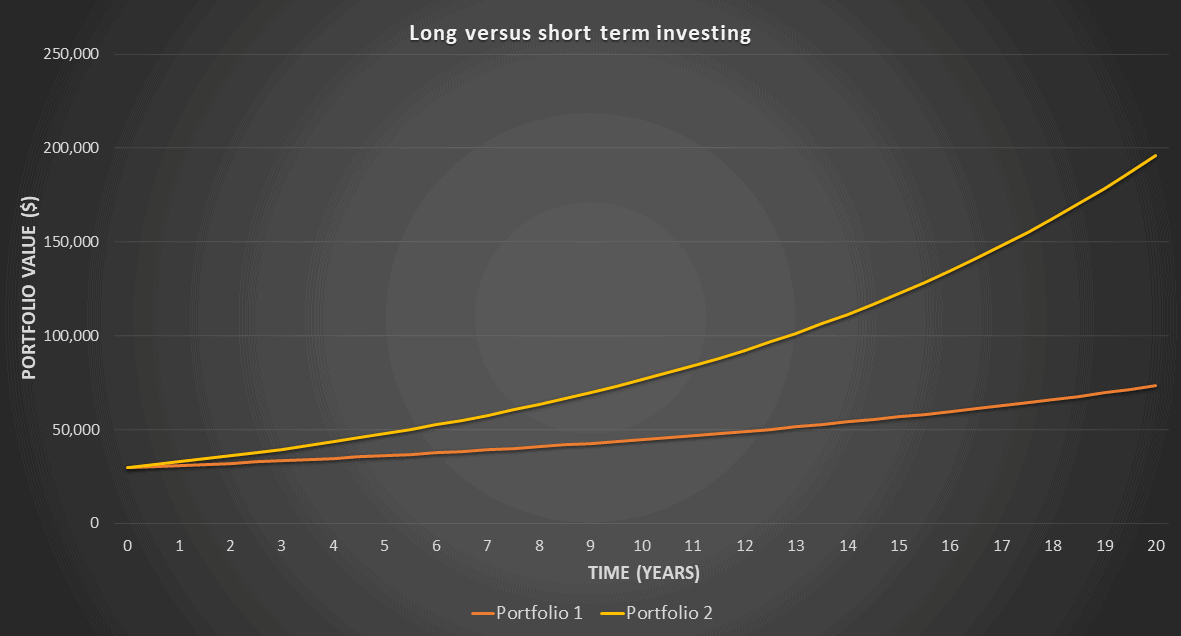

For this exercise, we will compare 2 portfolios, both containing a starting investment of $30,000 evenly spread across 15 shares. In addition, we'll assume an annual return of 10% and brokerage fee of $15 per trade. Lastly we'll apply a marginal tax rate of 32.5% to calculate the CGT. This rate is applicable for a taxable income between $37,001 – $90,000.

Portfolio 1 – short-term investing

For our short-term investing portfolio, we will assume an average holding period of 6 months. This means that the whole portfolio will be turned over every 6 months.

The drawbacks of this frequent trading are paying CGT on 100% of the returns and the large brokerage costs of $900 per year.

Frequent trading often occurs as a result of emotional trading. That is, trading in and out of positions frequently based on company news and market sentiment. Instead, I believe looking beyond market sentiment and sticking with companies through volatile periods can be a great way to reduce costs and, therefore, boost returns.

Portfolio 2 – long-term investing

For our long-term investing portfolio, we will assume that only 1 out of the 15 companies is sold and replaced each year.

This strategy benefits from lower CGT, only $30 in brokerage fees annually and that tax free compounding effect we get from a low turnover.

This chart shows the above 2 portfolios' growth over a 20 year period, and the effects can be sobering. The long-term investing portfolio has delivered a return 167% greater than that of the short-term. This is despite both portfolios achieving the same, 10% average annual return. See how significant the effects of all the additional trading and CGT can be on your returns?

Chart by author

Foolish takeaway

Here at Motley Fool, we are long-term investors through and through. We believe the compounding effect and overall benefits of long-term investing make it the single greatest way to build wealth over time. A few ASX shares I'm holding for the long term are ResMed Inc (ASX: RMD), Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) and Cleanaway Waste Management Ltd (ASX: CWY). I believe all 3 of these companies have exciting futures and, as such, I plan to hold them for the next decade.