Our Millennial Investor Series is focused on helping the younger generation understand the basic principles of money management and support them in achieving their financial goals.

The idea of investing in the sharemarket is something that can be very daunting to most millennials.

We have all heard the horror stories of the trader who lost all of their money or those who were left in severe financial hardship after the Global Financial Crisis wiped out a considerable portion of savings.

I'm also sure the current volatility is quite discouraging amidst the uncertain economic environment caused by the coronavirus pandemic. However, much of our fear stems from a lack of understanding, and it is this lack of understanding that tends to hurt investors more than the inevitable dips that will occur along the way.

So before we get into the complexities of the market, let's first define exactly how the share market works.

What is the share market?

A share market is where investors 'meet' to buy and sell investments. It works in a very similar manner to real estate auctions — where through a broker, buyers and sellers negotiate a price and make a trade.

The companies on the market issue shares and each share represents a proportionate ownership of the company itself. For example, if Company A had 10 shares outstanding and we own 1 share, then we would have a 10% ownership stake in the company. In other words, we would own 10% of the company's assets and any liabilities, as well as any earnings it may be generating.

How do investors make money?

On the share market, this is generally done in two ways: capital gains and dividends.

Capital gains

A capital gain occurs when the value of the investment is higher than what it was worth at its original purchase price. For example, if I bought 5 CSL Limited (ASX: CSL) shares at $200 per share and later sold those shares for $300 per share, then I will receive a capital gain of $500. This is because I initially invested $1,000 and in return received $1,500 when I sold.

Dividends

When a company generates a profit, it can distribute a proportion of this profit as a dividend. For example, if Telstra Corporation Ltd (ASX: TLS) generates a profit of 20 cents per share, it could decide to distribute 16 cents back to its shareholders. If Telstra shares were currently trading for a price of $3.20 per share, then it would be paying its shareholders a dividend yield of 5% (16 cents divided by $3.20 = 5%).

The nature of the share market

For new investors, it is also important to understand that markets are volatile and the level of uncertainty is high due to an infinite number of possibilities.

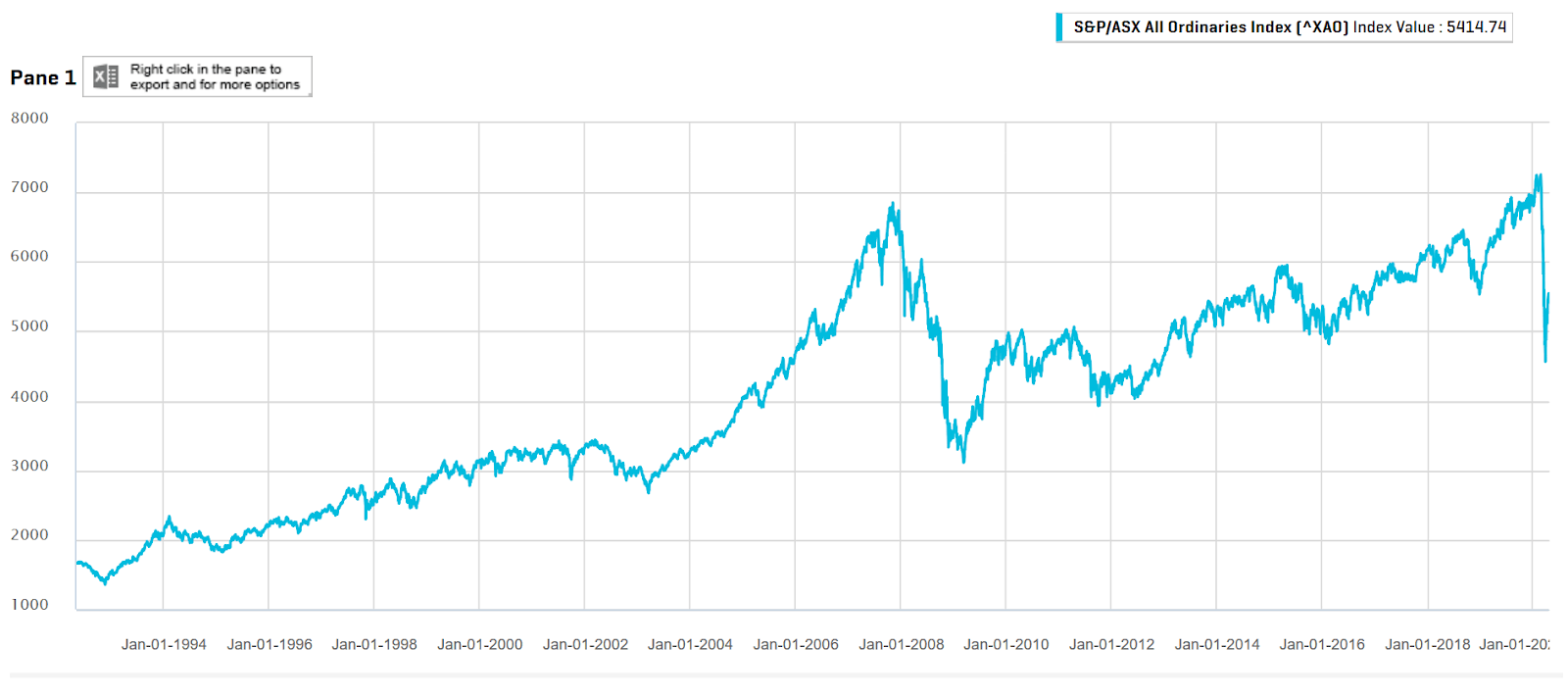

If we look at a chart of the All Ordinaries Index (ASX: XAO) over the last few decades, it is clear that it does not move in a straight line.

Company share prices and markets as a whole can fluctuate dramatically over the short term based upon economic factors and the overall sentiment of investors.

Our job as investors is to determine the most likely outcome and identify the obstacles along the way that may impact on that outcome being achieved. Once understanding the risks and rewards involved in achieving a certain outcome, we then decide whether or not the risk/reward ratio is in our favour and invest accordingly.

The uncertainty involved with investing in shares, combined with the expected volatility of our investments, is what allows us to generate stronger returns from equities than from risk-free cash investments. Hence, for those with a longer-term investment horizon, volatility should be embraced, rather than feared.

As a long-term investor, the approach we take is to focus on the performance of the business and its prospects several years down the track. We seek to avoid letting the short-term price fluctuations of a share impact upon our thoughts on the long-term prospects of the business itself.

One common mistake inexperienced investors make is they let fear dictate their next move.

As stated by Warren Buffett — one of the most successful investors over the last several decades — 'we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful'.

Many investors make the mistake of selling at the most inopportune time; they sell at the height of market fear and decide that investing is not for them.

That is why we often highlight to any new investor that investing requires patience and an ultra long-term mindset. Recognise your investments at some stage could fall dramatically but remind yourselves during these times that history has shown 'this too shall pass'.

The number 1 piece of advice that we can give to any new investor is that when you purchase shares on the market, you are buying an ownership stake in a company. Whilst the share price in the short term can fluctuate due to sentiment, over the long term a company's share price tends to move in lockstep with its underlying business performance.

To summarise share market investing into one small sentence: Find high-quality companies, invest for the long term, and let the power of compounding do the rest.

A note from the writer

Hi everyone. I am Chris Copley, an analyst at The Motley Fool, providing research on Motley Fool Dividend Investor, Hidden Gems and Everlasting Income.

At The Motley Fool, we are receiving more and more requests to provide support for Millennial Investors. As a Millennial Investor myself, helping younger investors is something I am very passionate about and strongly believe that with the right support and education we as Millennials have a prodigious opportunity to achieve our financial goals at an enviable age.

Each week I will release a new topic on investing principles A-Z and provide younger investors with all the basic tools they need to thrive in an ever-complicated financial world.

So follow along with me on your investment journey.

For new investors, we suggest that you start from the beginning. You can follow along from our previous articles below.

Here's what every millennial should know about getting started investing in the stock market

Why it's important for millennial investors to define their goals