This is the first article in our Millennial Investor series focused on helping the younger generation understand the basic principles of money management and support them in achieving their financial goals.

A journey of a thousand miles begins with a single step.

I'm sure many of you have heard the old proverb. The problem is the first step is usually the hardest to make. When the destination seems so far away, we are wired to continually delay until we reach a point where there is no way that we are going to comfortably reach the finish line – at least in our desired time frame.

We probably all have financial goals which may include wealth creation, achieving financial independence or to eventually buy that dream house, but surprisingly, starting our investment journey is something that many of us millennials don't even consider. Whether it is simply something we ignore until we reach a certain point, or we just simply don't understand the benefits that it can bring.

Now the first thing that I will point out is the journey is not – and should not – be the same for everyone. We all have our personal situations, risk profiles and goals that should absolutely impact upon our own strategies and approach.

That being said, we should all have our eyes wide open to the possibilities, opportunities and obstacles along the way. This can make our trek less arduous and instead something that we can enjoy, or at least tolerate, with as little stress as possible.

So, let's start at the beginning of our journey.

When should we start investing?

Let's answer that with an example of two different investors, Sarah and Matt.

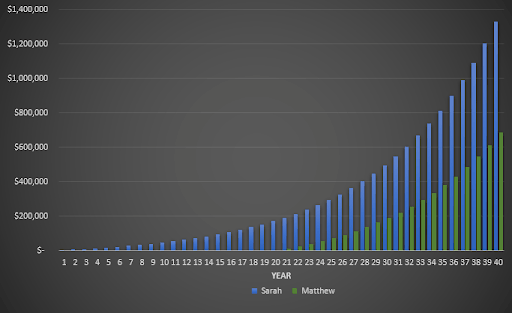

Sarah is 20 years old and decides to start investing. She invests $3,000 a year over 40 years into the sharemarket and generates the average market return. Matt is 40 years old and invests $12,000 a year over 20 years into the sharemarket and also generates the average market return.

To keep things simple, we will assume that the market returns 10% per annum, which is close to the historical long-term average return of equities.

This is the result.

Over their investing lifetime, Sarah deposited $120,000 and Matt, on the other hand, deposited $240,000. Yet when they reach the age of 60, the value of Sarah's savings is nearly twice that of Matt's. With a relatively small yearly deposit of just $3,000, Sarah has amassed over $1.3 million.

Such is the power of compounding and highlights why young investors have the upper hand.

Now, let's consider if Sarah was to delay investing for one year. What would the impact be on her savings by the time she reaches 60? If Sarah starts at 20, she will have a total balance of $1,327,778, yet if she starts at 21 she will have $1,204,343. This is more than $123,000 less than if she started a year earlier.

There is a common misconception that investing is just for the older generations. In reality, due to our longer investment horizon and the power of compounding, it is the younger investor who has all the advantage.

We at The Motley Fool love to say it's never too late to start investing. This is undoubtedly true, but ask your parents or your grandparents and you will find that they will all say the same thing: 'I wish I started investing earlier'.

For those of you who are currently yelling at your screen saying, "I have no savings! I can't start investing without savings!" First of all, you're right. Sorry, that is a prerequisite. However, you don't need money to start your investment journey.

The journey starts with the first and most important step, and that is acquiring the basic knowledge of money management and an understanding of how you can use the power of compounding and sound investment decisions to your favour. By acquiring this basic knowledge, I am confident that you will reach your financial goals at a rate that many of you did not think possible.

So for those of you who are still with me — don't worry I get it, this article does not come in meme form so undoubtedly many have drifted off — I would just like to leave you all with one key statement!

Make today the day that you take the first step on your investment journey.

A note from the writer

Hi everyone. I am Chris Copley, an analyst at The Motley Fool working on Motley Fool Dividend Investor, Hidden Gems and Everlasting Income.

At The Motley Fool we are receiving more and more requests to provide support for Millennial Investors. As a Millennial Investor myself, helping younger investors is something I am very passionate about and strongly believe that with the right support and education we as Millennials have a prodigious opportunity to achieve our financial goals at an enviable age.

Each week I will release a new topic on investing principles A-Z and provide younger investors with all the basic tools they need to thrive in an ever-complicated financial world.

So follow along with me on your investment journey.