What a week!

The S&P/ASX 200 Index (ASX: XJO) has just had 5 of the most memorable trading days in living memory. Despite a 'comeback of the century' recovery on Friday, it was destined to be the worst week for ASX shares since the depths of the global financial crisis of over a decade ago.

Of course, the fuel for the selling bonfire continues to be provided by the COVID-19 pandemic.

This week was marked by prime-time TV addresses from both our Prime Minister Scott Morrison, and President Donald Trump over in the USA. Further travel restrictions as well as a ban on public gatherings of more than 500 people have been announced, and it seems more measures will be put in place to contain this virus in due course.

The record highs we were seeing just one month ago seem a distant memory already.

The ASX 200 has now fallen 22.96% from the peak reached in mid-February. We are still firmly in bear market territory, and the '2020 crash' is solidifying as a defining moment in the history of the ASX.

Let's recap!

How did the markets end the week?

On Monday, the ASX 200 was sitting at 6,216 points.

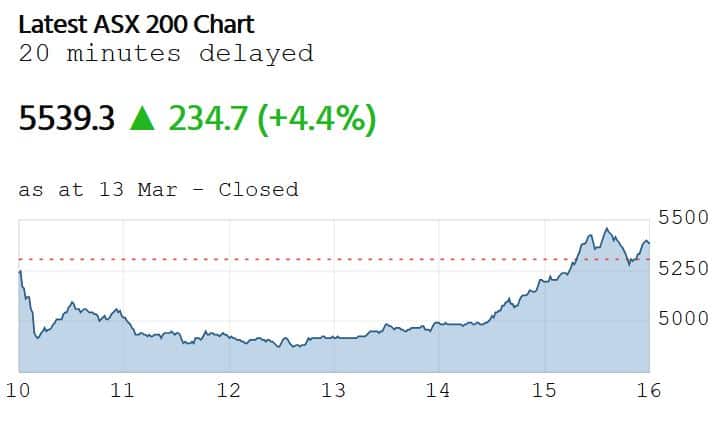

On the closing bell on Friday afternoon, we had a level of 5,539.3 points – a drop of 10.89% for the week.

Yet this number only tells half of the story.

Monday saw a drop of 7.33%. Tuesday – a rise of 3.11%. Wednesday then saw a reversal with another drop of 3.6%. On Thursday, we had a nasty fall of 7.36%.

Then came Friday.

Soon after Friday's open, we seemed to be staring down the barrel of oblivion with what was looking to be a fall of over 8% for the ASX 200 to 4,874 points.

ASX shares had seemingly gone into freefall and panic was everywhere. Some brokering websites were even crashing under the strain.

But then, something truly extraordinary happened. The ASX managed to reverse all losses and ended up finishing ahead for the day. Not just ahead either – 4.42% ahead.

That's right, the ASX actually had a 12% turnaround mid-session. It was truly something incredible to behold (told here from firsthand experience!).

Just take a look at the graph of Friday's ASX 200 moves below for some proof. It almost resembles a skate-park installation!

It wasn't enough to save the index from having its worst week since the GFC, but the bleeding was staunched. Meanwhile, the ALL ORDINARIES (ASX: XAO) was down 11.07% for the week. The Aussie dollar has also continued to slide and is now perilously close to falling below 60 US cents – sitting at 61.82 cents as we start the week.

Which ASX shares were the biggest winners and losers?

Let's take a look at the biggest winners and losers on Friday. Here are the losers:

As you can see, gold stocks like Gold Road Resources Ltd (ASX: GOR) were amongst the losers last week as the gold price failed to compensate for the falling stock market. Other losers all have close ties to the coronavirus. The Qantas Airways Limited (ASX: QAN) share price is starting to approach the $3 mark as travel bans extend and the Prime Minister tells Australians not to travel unless absolutely necessary.

Unibail-Rodamco-Westfield (ASX: URW) is also in the firing line as there's no doubt its European shopping centre foot traffic is going to be substantially affected by travel restrictions and bans on public gatherings.

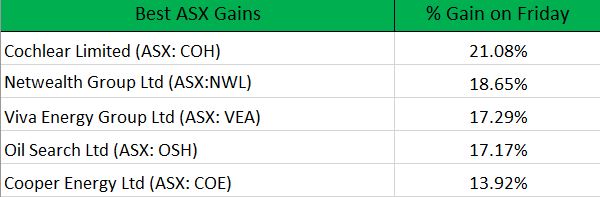

And with the bad news out of the way, here are Friday's winners:

Healthcare giant Cochlear Limited (ASX: COH) tops the list with a heart-fluttering 21.08% gain without too much cause. It seems investors aren't too concerned about healthcare companies at the present time.

Oil stocks like Oil Search Ltd (ASX: OSH) and Viva Energy Group Ltd (ASX: VEA) also experienced some healthy rebounds after last week's rout. Oil prices have yet to recover after the oil price plunge last week, but clearly investors have decided that the fire sale of oil shares last week was overdone.

What is this week looking like for the ASX?

Well, after last week, it's safe to say that anything could happen this week. I myself am expecting more extreme volatility and I think it would be wise to adopt similar expectations.

There are signs that both the Reserve Bank of Australia (RBA) and the US Federal Reserve are planning more monetary easing (which has the potential to move markets), but we will have to wait and see if and how this materialises.

A lot of the volatility we saw on global markets last week was prompted by the responses (or lack thereof) from the White House over in the US, so that will be something to keep an eye on.

I think it's also worth noting that a typical bear market (as we are now in) historically lasts for at least 6 months if not longer, so that's something to keep in mind as we start the new week. We are nowhere near being close to out of the woods yet in terms of the coronavirus situation, so I think it would be wise for all investors to be prepared anything.

So with that said, here's how the top ASX blue chips are looking as we start this week:

And finally, here is the lay of the land for some leading market indicators:

- S&P/ASX 200 (XJO) at 5,539.3 points

- ALL ORDINARIES (XAO) at 5,590.7 points

- Gold is asking US$1,529 per troy ounce

- Brent crude oil is trading at US$33.85 a barrel

- Australian Dollar buying 61.82 US cents

Foolish takeaway

Before we go, I would like to take this time to wish all of our readers the very best during this tough time. It's a confronting moment for us as Australians and on behalf of myself and all of my Foolish colleagues, I would like to extend our well-wishes to all as we face this together.

It's a tough time to be in the share market, but we Fools feel your pain at least in equal measure and are with you every step of the way!