In times of economic uncertainty investors often flock to the safe haven of gold and flee out of ASX shares. In the past 12 months, the gold price has increased by 26% compared to the S&P/ASX 200 (INDEXASX: XJO), which is up 21% excluding dividends.

While the overall index of the top 200 Australian companies has lagged the gold price, there have been star performers over the past 12 months:

- Afterpay Ltd (ASX: APT) share price up 137%

- Altium Ltd (ASX: ALU) share price up 65%

- Fortescue Metals Group Limited (ASX: FMG) share price up 162%

- Xero Limited (ASX: XRO) share price up 101%

Unfortunately, there is no guarantee that all share selections will soar like the ones mentioned above.

But there is also the potential for massive share price growth.

In the past 30 years, according to the Vanguard 2019 Index Chart, Australian shares has delivered a return of 9.4%p.a. So, $10,000 invested in 1989 with no acquisition costs or taxes and all income reinvested will be worth a sizeable $146,337 in 2019, as per Vanguard. This is despite different governments and many economic shocks.

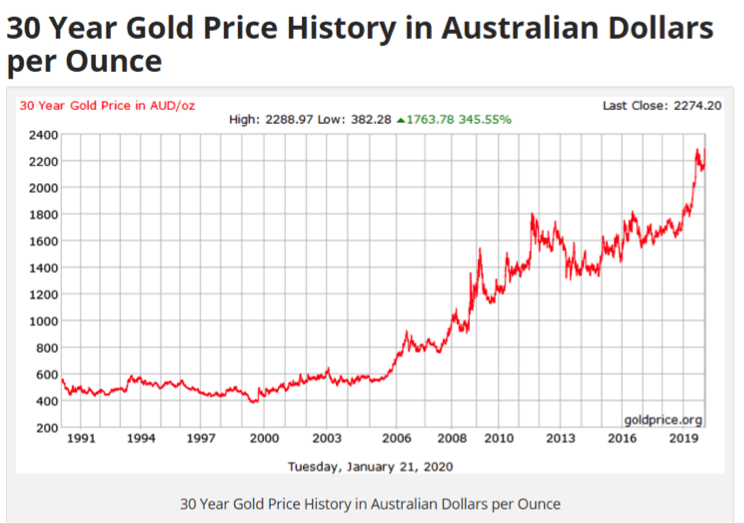

The price of gold has risen by 345% in Australian dollar terms in 30 years, as can be seen by the chart below:

Source: https://goldprice.org/

The downside to gold is that it doesn't provide cash flow unless you sell. In comparison, you can own shares that pay you dividends and deliver share price growth. When you include dividends in the return of the ASX 200, it bumps up to 25%. This only just lags the performance of gold in the last 12 months.

When speaking about gold, Warren Buffett once said "It doesn't do anything but sit there and look at you". Actual physical gold does just that, but an investment in an ASX gold company directly can provide you with dividends and potential share price growth. Gold is also used in consumer products.

There are several options to invest in gold. You could buy physical gold, a gold ETF like ETFs Physical Gold (ASX: GOLD) or buy a gold listed ASX company like Newcrest Mining Limited (ASX: NCM). The downside of owning actual physical gold is the storage cost and the stress of keeping it safe..

Foolish takeaway

It's strange to see the ASX 200 and the gold price delivering similar returns in the past 12 months. While gold doesn't provide cash flow unless you buy a dividend-paying company in the gold industry, ASX shares can deliver consistent and growing income streams for investors looking for passive income even through uncertain economic times.