Well, the ASX isn't having one of its better days.

At the time of writing, the S&P/ASX 200 (INDEXASX: XJO) is down around 0.31% to 6,712 points. ASX blue-chips like Commonwealth Bank of Australia (ASX: CBA), National Australia Bank Ltd (ASX: NAB) and Woolworths Group Ltd (ASX: WOW) have all taken share price haircuts. Even market darling CSL Limited (ASX: CSL) is down 0.12% to $277 a share.

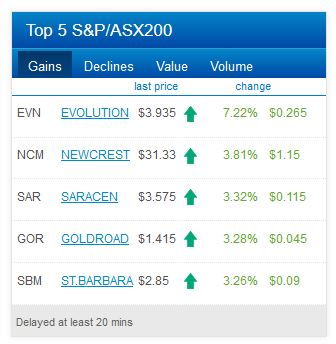

But if you look at the ASX's leader board this afternoon, there is a striking theme going on – see if you can… spot it

Source: ASX.com.au

That's right, ASX gold miners are the shining light of the markets on this Monday afternoon. All 5 biggest gainers today – Evolution Mining Ltd (ASX: EVN), Newcrest Mining Limited (ASX: NCM), Saracen Mineral Holdings Limited (ASX: SAR), Gold Road Resources Ltd (ASX: GOR) and St Barbara Ltd (ASX: SBM) – boast depositories of the yellow metal.

Why are gold miners bucking the trend today?

I think it's widely accepted that today's market pessimism has a lot to do with the US–Iran tensions that have spectacularly escalated over the weekend. Geopolitical uncertainty is an anathema to global markets generally and the Aussie markets are no exception.

The only asset that does well in uncertain times such as these is… you guessed it, gold. Gold is the ultimate 'safe haven' asset and demand for safe havens usually rises when international tensions increase.

We have seen this play out in perfect textbook form. Just this time last month, an ounce of gold would have set you back US$1,460. Today, that same ounce is going for around US$1,580 – an 8.2% turnaround.

It's for this reason gold miners are enjoying such robust gains on the markets today. As mining costs are relatively static for these companies, any increase in the price of gold represents a disproportionate increase in profitability.

For example, Newcrest (the ASX's largest gold miner) boasted a cost per ounce of US$738 in FY19. That means that over the past month (if we assume a continuation of this cost base), Newcrest's profit margins have gone from US$722 per ounce mined to US$842 per ounce.

Even though the price of gold itself has increased 8.2% during this period, Newcrest's profitability has increased 16.62%.

Foolish takeaway

I think today's market moves do nothing to dampen the ASX gold miners' reputation as something of a hedge against broader market falls. Whilst I don't use such a strategy myself, it's always worth noting how these mini-cycles play out in market from time to time.