A strange thing happens from time to time – our government decides to join the fun on the ASX by offloading assets to the public markets.

Politics is a funny business, and so every now and again, the governing party decides that some state-owned company or another would do better by leaving the walled gardens of government.

While this might sound boring to a lot of investors out there, companies that used to be owned by the government are actually some of the best-performing ASX shares you can buy today.

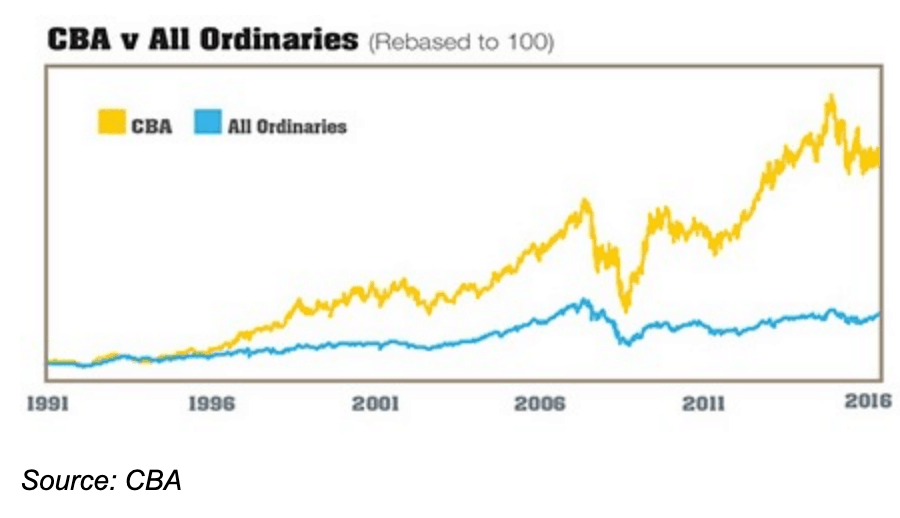

Consider Commonwealth Bank of Australia (ASX: CBA). Whilst it might seem inconceivable today, CommBank used to be a government-owned business in its entirety. When CBA was eventually pushed out of the nest by Paul Keating back in 1991, you could pick up shares for just $5.40. Considering CBA shares will set you back over $80 today, it would have been a good move to get in early in hindsight (to say the least) – just check out the chart below.

It's more than CommBank though. Our beloved Qantas Airways Ltd (ASX: QAN) went through the same process, as did CSL Limited (ASX: CSL) and perhaps most famously Telstra Corporation Ltd (ASX: TLS)

In fact, CSL wins the prize. Its IPO price was just $2.30 per share back in 1994 (again, thank you Mr Keating) – a far cry from the $273 price CSL shares command today.

Telstra is probably the biggest loser to date from the whole process. Some of Telstra's shares were sold off for over $8 in the late 1990s – a share price that has never been breached since.

There are a string of other government IPOs that now litter the ASX – both state and federal government initiated. Suncorp Group Ltd (ASX: SUN) was spun out of the Queensland government back in 1997.

Most recently, Medibank Private Ltd (ASX: MPL) left the confines of government back in 2015 – when Medibank hit the markets for $2 per share. Since MPL shares are currently at $3.16 (and were nearly $3.70 just a couple of months ago), I would also call this float a resounding success.

Foolish takeaway

What we can gather from all this is when the government decides to offload a business – it's probably well worth checking out! Getting CSL or CBA shares on their initial offerings would have been a stunningly lucrative and successful move. So next time the government decides to sell off some of the family silverware – I'll be watching like a hawk!