The Pointsbet Holdings Ltd (ASX: PBH) share price is up 5% to a record high of $4.73 today despite the sports betting business not releasing any specific news to the market.

The stock is now up more than 130% since listing on the ASX at $2 per share in June 2018 and as far as I'm aware much of the investor enthusiasm is related to its ability to profit from the deregulation of sports betting markets in the United States.

Over the 12 months to June 30 2019 it posted a net loss of $41.9 million on revenue of $25.6 million, which is not too flash, but backing out one off costs the net loss only came in at $37.2 million. It also reported a net cash outflow from operating activities of a little over $21 million.

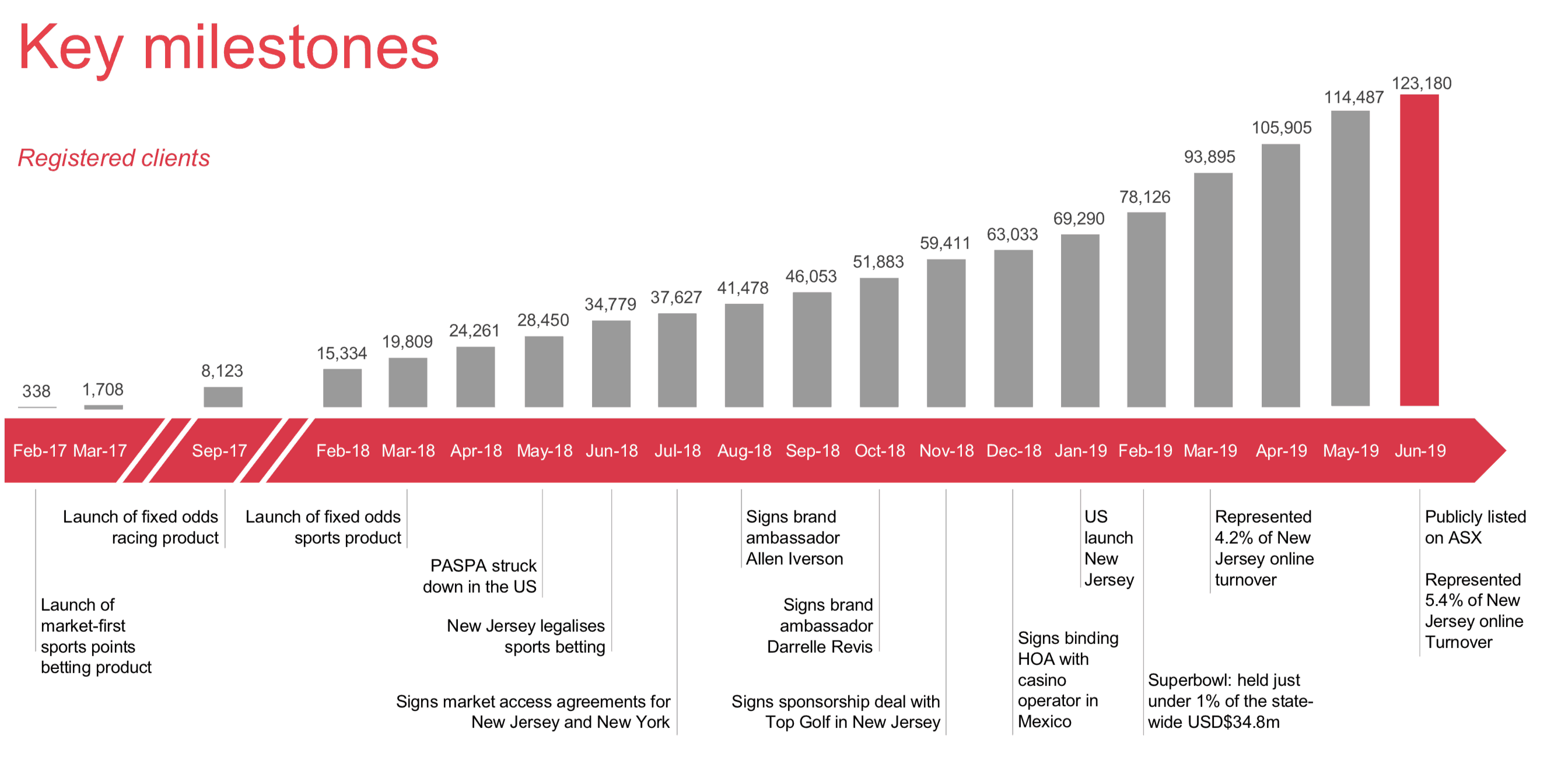

The below chart offers a timeline of its client growth since February 2017.

Source: Pointsbet presentation, Aug 29, 2019.

Source: Pointsbet presentation, Aug 29, 2019.

Pointsbet has been growing in Australia nicely as a reasonably vanilla online sports betting operator, but Australia is a mature market where you can even gamble (responsibly) over-the-counter in the pub.

The US until recently had banned pretty much all sports betting. However, the throwing out of the Professional and Amateur Sport Protection Act by the US Supreme Court in May 2018 means huge sports betting markets are now potentially available to online players able to get state licenses.

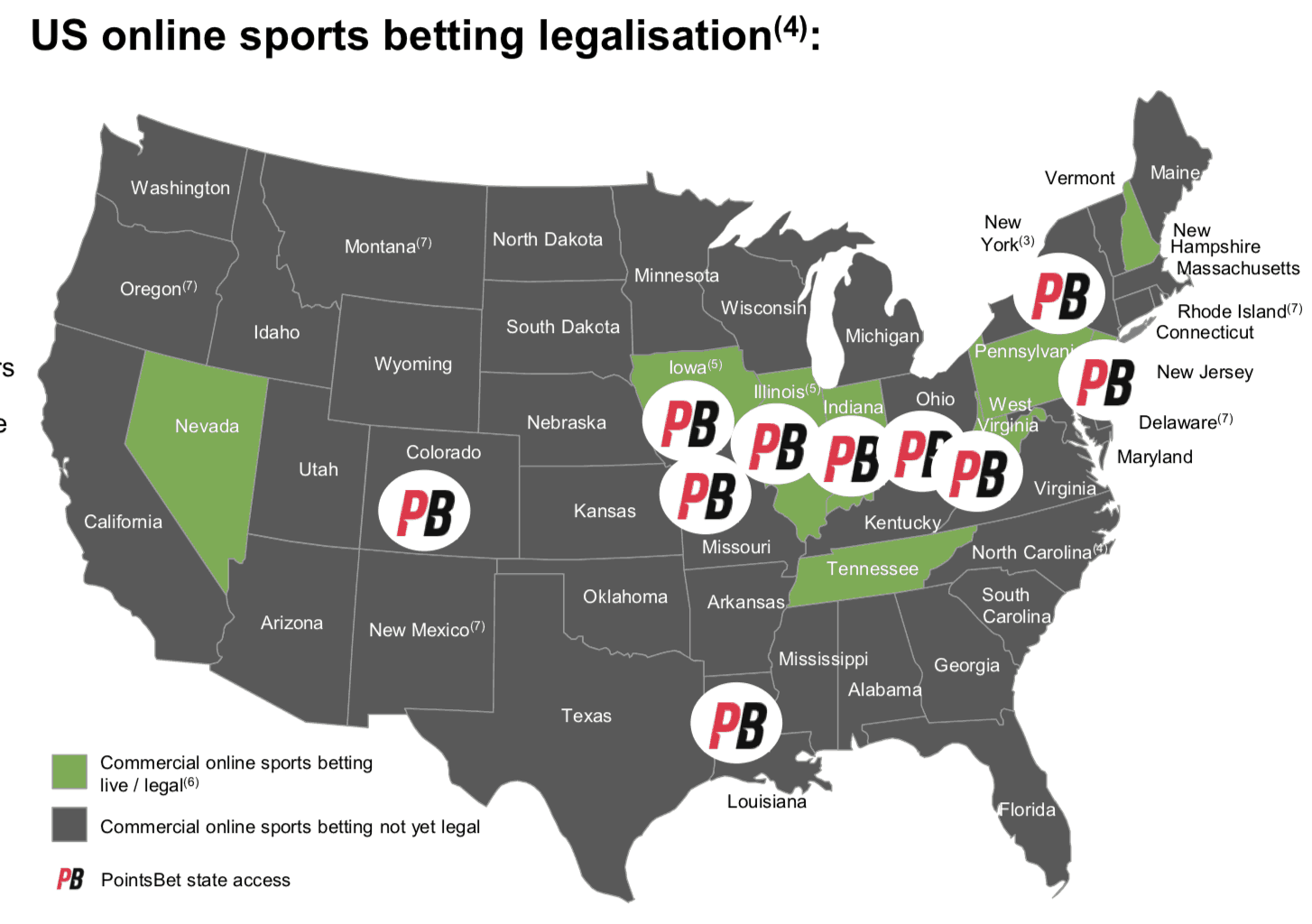

PointsBet now has the ability to offer sports gambling markets in the states of Ohio, Indiana, Missouri, West Virginia and Louisiana, subject to enabling legislation and licensing in each state via a deal it has agreed with Penn National Gaming.

Below we can see a rough chart of its existing US market access, although it's worth noting the chart is heavily footnoted to define the exact nature of its current access.

Source: Pointsbet presentation, Aug 29, 2019.

The balance sheet is also strong with cash on hand of $75.9 million as at June 30, 2019, after it raised $75 million at IPO.

According to its latest regulatory filing Appendix 3B it has 91.35 million shares on issue to give it a market value around $432 million, with another 24.8 million shares escrowed until no longer than June 2021 to factor into the valuation.

Pointsbet is one of a number of rising digital or tech businesses investors might want to look into with others including EML Payments Ltd (ASX: EML) and Audinate Group Ltd (ASX: AD8).