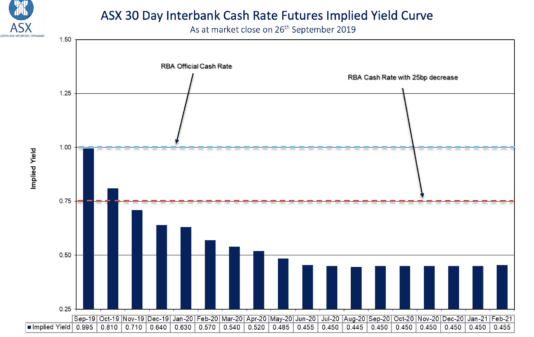

Next week it is looking increasingly likely that the Reserve Bank of Australia will cut the cash rate down to a record low of 0.75%.

After which, by May of next year the market believes another cut will have taken place, bringing the cash rate down to just 0.5%. This can be seen on the graph below.

Judging by both recent economic data and comments out of the central bank, I suspect that these forecasts will prove accurate. Which means that income investors are going to have to contend with ultra-low rates for some time to come.

But don't worry because the three dividend shares below offer generous yields to solve your income needs:

Lendlease Group (ASX: LLC)

I think this international property and infrastructure company is worth considering. FY 2019 was admittedly a disappointing year, but I remain confident that the worst is behind it now and think investors should focus on the future. Especially given its recent announcement of a~$20 billion multi-year project with tech giant Google in the United States. At present I estimate that its shares offer a fully franked 3.7% FY 2020 dividend yield.

National Australia Bank Ltd (ASX: NAB)

Although this banking giant's shares have recently hit a 52-week high, I still see a lot of value in them and believe they could provide good total returns for investors over the coming years. Especially if the housing market rebounds and drives solid mortgage loan growth in the near term. Based on its interim dividend being annualised, NAB's shares currently offer a 6.2% fully franked dividend yield.

Super Retail Group Ltd (ASX: SUL)

Due to its attractive valuation, generous dividend yield, and positive outlook, I think Super Retail is a good option for income investors right now. At present its shares offer a trailing fully franked 4.8% dividend yield, but I believe it is well-positioned to increase this in FY 2020 thanks to the improving outlook for the retail sector due to tax cuts and a potential housing market rebound.