This morning Breville Group Ltd (ASX: BRG) released its results for the financial year ending June 30, 2019. Below is a summary of the results with comparisons to the prior year.

- Revenue of $760m, up 17.5%

- EBITDA of $114m, up 13.7%

- Net profit $67.4m, up 15.2%

- Final dividend up 12% to 18.5cps, full year dividends 37cps

- Basic earnings per share of 51.8c

- Return on equity 22.7%

- Net cash position of $9.8m, compared to $58.9m in prior period

This is another strong result from the Sydney-based kitchen appliance group with revenue growth in North America and Europe particularly strong at 19.6% and 42% respectively.

The group tends to focus on selling 'premium' products to households not so budget conscious as market-leading products can command big profit margins.

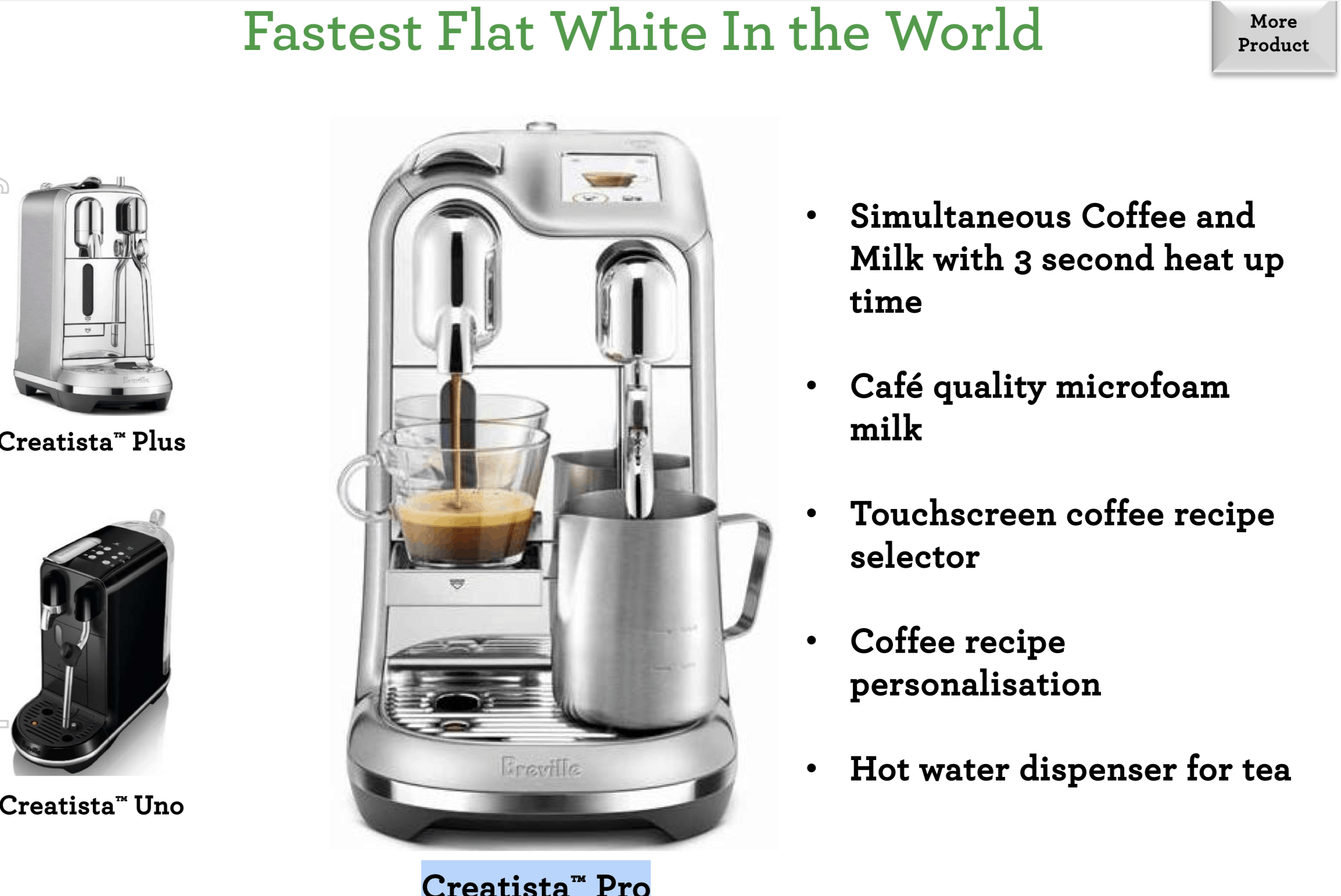

As such its innovative new range of inter alia, coffee machines, juicers, kettles, microwaves, and food processors enjoyed a strong year of sales and at the premium end of the market there is constant opportunity to launch new products.

Check out its latest coffee machine below.

Source: Breville Presentation, Aug 15, 2019.

The stock recently hit a record high of $19.38 and is up around 125% over the past 5 years before dividends. Today it sells for $18.60 on 35x trailing earnings with a 2% trailing yield, which looks on the expensive side to me.

However, it looks a high quality operation with a decent balance sheet, return on equity, track record of growth and innovation.

It's also majority owned by another high-quality retail operator in Premier Investments Limited (ASX: PMV).

Other good quality retailers to look at include Brett Blundy backed footwear retailer Accent Group Ltd (ASX: AX1), electronics retailer JB Hi-Fi Limited (ASX: JBH) and the fast-growing a2 Milk Company Ltd (ASX: A2m).