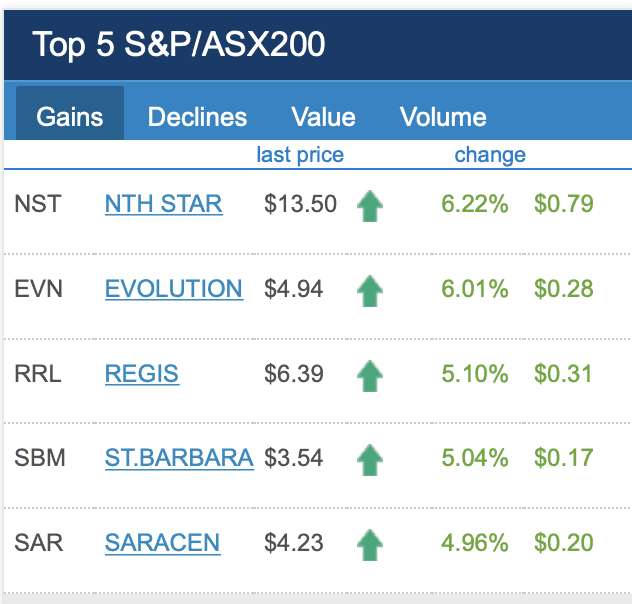

The best shares on the S&P/ ASX200 (ASX: XJO) today are Australia's gold miners such as Northern Star Resources Ltd (ASX: NST), Evolution Ltd (ASX: EVN), Regis Resources Ltd (ASX: RRL), Saracen Resources Ltd (ASX: SAR) and St Barbara Resources Ltd (ASX: SBM).

Just look at the gold glittering leaderboard below.

Source: ASX website, July 19, 2019.

Why is the gold price going higher?

Overnight a member of the US Federal Reserve, John Williams, was attributed dovish comments about his belief that central banks should "act quickly" to get ahead of the game in cutting cash rates ahead of any further economic problems.

Markets have interpreted these comments to mean that the US Fed might cut interest rates up to 50 basis points at its July 31 meeting, which would have downstream consequences for other asset classes.

For starters gold becomes hotter in a lower risk-free rate world, while a weaker U.S. dollar also makes gold more attractive to international investors buying the asset in overseas currencies either physically or synthetically.

Gold exposure is often tipped by professional money managers or advisers as a 'flight to safety' bet or hedge against a market crash, as it's widely considered to be a 'store of value' less vulnerable to real world recessions or financial crises that hurt companies' profits or the like.

On the other hand though a weaker U.S. dollar is a negative for Australian gold miners as it means they receive less Australian dollars for their product given it's sold in U.S. dollars.

As such it's important to remember they're many different forces pushing and pulling the gold price to mean it can move in mysterious ways.

Still with gold up 1.5% to 52-week highs of US$1,444 per oz this morning we can see that as a general rule it should rise as U.S. cash rates fall or if the economic world goes to hell in a handcart.